India’s e-commerce engine is shifting gears, and it’s not the metros leading the charge anymore. The real action is happening in Tier 2 and Tier 3 cities like Jaipur, Indore, Surat, Patna, and Kochi. With affordable smartphones, cheap data, and rising digital literacy, these cities are producing millions of new online shoppers who are curious, aspirational, and eager to try new brands.

For direct-to-consumer founders and small business owners, this is more than just a trend. It is the biggest growth opportunity in Indian e-commerce today. But tapping into this demand comes with its own set of challenges. Reaching these new customers is not just about ads or influencer marketing. It is about whether your logistics can keep up.

Shipping to smaller towns is a different game. From narrow lanes to inconsistent addresses and limited courier coverage, it can get messy fast. That is why the way you ship matters more than ever.

You typically have two options. Express shipping gives you fast delivery and a premium experience. Economy shipping is slower but significantly more affordable. Each has its own advantages and trade-offs. Choosing the wrong one can lead to late deliveries, higher return-to-origin rates, and upset customers.

This blog explores how you can make the right shipping choices for the next wave of online India. Because in Bharat, shipping smart is the only way to scale fast.

Why Tier 2 and 3 Cities Matter More Than Ever

Tier 2 and 3 cities are no longer on the sidelines of India’s digital economy. They are quickly becoming the core growth engine for e-commerce, especially for direct-to-consumer brands and small to medium businesses.

Here is why these markets now demand serious attention:

- Over 50 percent of new online shoppers are coming from non-metro cities. This shift is driven by rising internet access and smartphone use in semi-urban and rural areas.

- Platforms like Meesho, Flipkart, Amazon, and Jiomart are seeing a sharp increase in orders from towns such as Guntur, Varanasi, and Hubli, reflecting deepening trust in online shopping.

- The pandemic accelerated the use of digital payments, including UPI and mobile wallets, even in remote locations. This makes online transactions smoother for first-time buyers.

- Social media platforms like Instagram, YouTube, and ShareChat in regional languages are driving discovery of new brands through influencer content, product demos, and word of mouth.

For D2C brands, this means growth is not limited to Delhi, Mumbai, or Bengaluru. The real competition is now playing out in cities like Indore, Coimbatore, and Guwahati. To win in these markets, businesses must rethink their logistics, delivery timelines, and customer communication strategies.

What is the Ground Reality of Logistics in Tier 2 and 3 India?

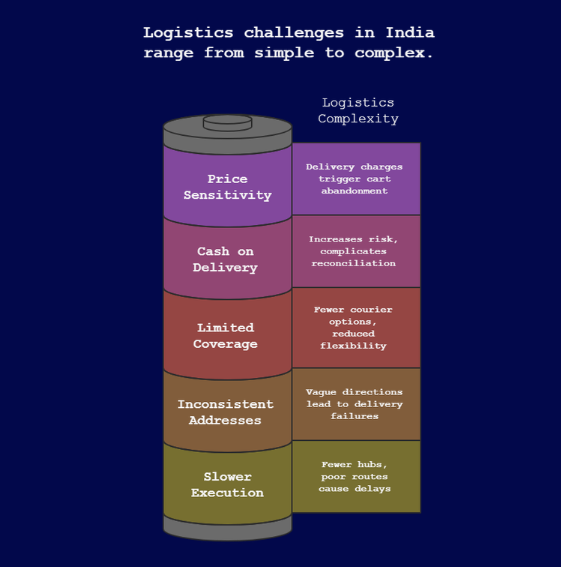

Reaching customers in Tier 2 and 3 India is not just about expanding pin code serviceability. It involves solving deeply rooted infrastructure and behavioral challenges that require both operational depth and cultural understanding. Here are five critical realities to consider:

1. Slower Last Mile Execution: Deliveries in smaller cities take longer due to fewer fulfillment hubs, limited personnel, and poor delivery route optimization. Delivery agents often cover large areas, causing delays and missed attempts.

2. Inconsistent Address Systems: Unlike metro cities with structured urban planning, many small towns lack clear address formats. Customers use local landmarks or vague directions, which often leads to delivery failures or excessive follow-ups.

3. Limited Courier Network Coverage: Not all logistics providers operate with the same efficiency in remote towns. Regional gaps in courier presence mean fewer options, reduced flexibility, and higher dependence on a single partner.

4. High Cash on Delivery Preference: Many buyers in these regions still prefer to pay only after receiving the product. This increases the risk of order refusals, adds pressure on working capital, and complicates the reconciliation process.

5. Price Sensitivity and Delivery Expectations: Customers are more conscious of every rupee. A delivery charge can trigger cart abandonment. At the same time, expectations for quick and reliable delivery are rising, shaped by exposure to larger marketplaces.

These factors make logistics in Tier 2 and 3 India more complex and demand tailored strategies that go beyond standard metro-focused solutions.

Choosing Between Express and Cost-Effective Shipping: What Works for Tier 2 and 3 India?

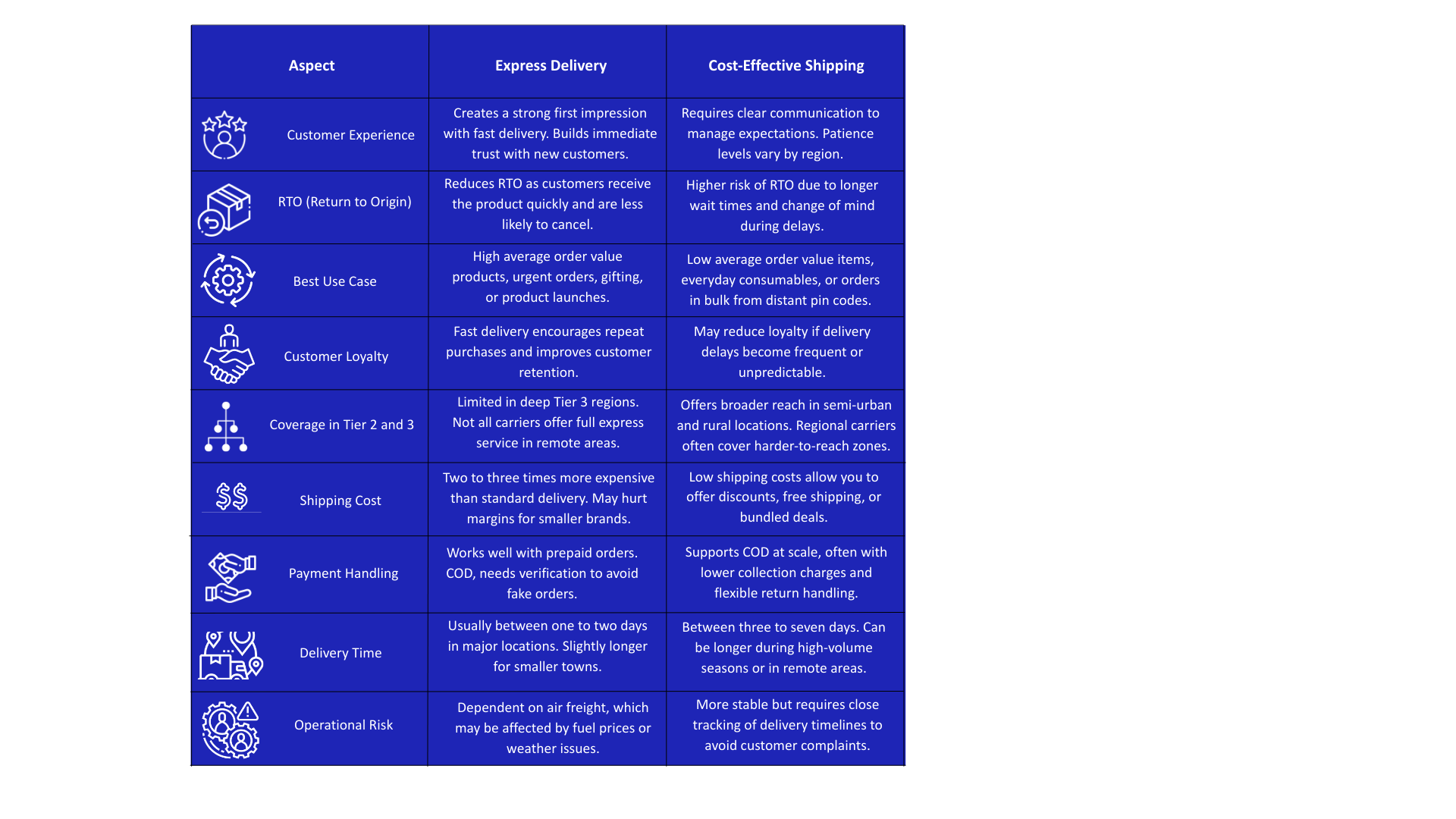

For D2C brands and small to medium businesses trying to build a strong presence in emerging Indian markets, logistics strategy is not just about delivery. It is about balancing speed, cost, trust, and customer satisfaction. The choice between express delivery and cost-effective shipping is one of the most important decisions a seller can make.

Express delivery is designed for speed. It typically delivers orders within one to two days, often by air and with high-priority handling. This builds trust, especially with first-time buyers, but comes with a higher cost and limited reach in remote areas.

Cost-effective or economy shipping focuses on affordability. It offers broader reach and better margins but with slower delivery speeds, usually between three to seven days. This can lead to higher return rates if not managed carefully.

Here is a detailed breakdown of the benefits and drawbacks of each option:

Comparison Table: Express vs Cost-Effective Shipping

If your product is high value, your target audience expects speed, or you are launching something new, express delivery can help you make a strong impact. If your focus is on affordability, scaling to more regions, or selling low-cost repeat items, economy shipping will protect your margins and expand your reach.

For most growing brands, a hybrid model often works best. Let customers choose, use data to segment shipping methods by product and region, and stay flexible as demand shifts.

What Should D2C Sellers and SMBs Consider Before Choosing a Shipping Model?

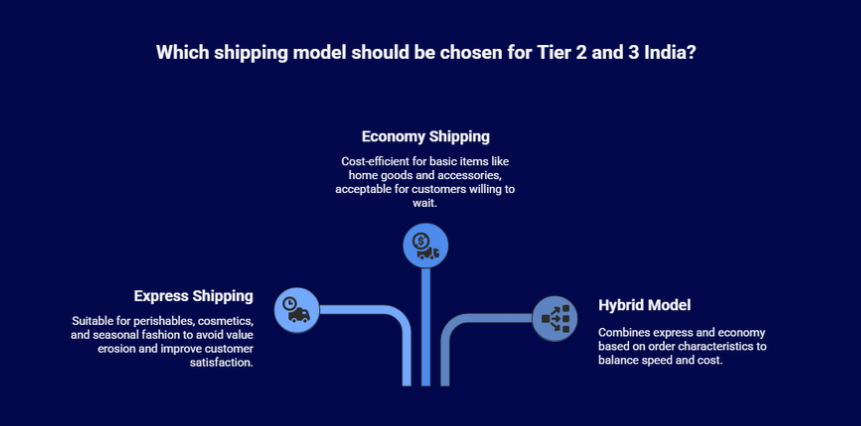

When it comes to logistics in Tier 2 and 3 India, there is no one-size-fits-all approach. Direct-to-consumer sellers and small businesses must weigh several trade-offs based on product type, margins, and customer expectations.

First, the nature of your product plays a major role. Items like perishables, cosmetics, or seasonal fashion pieces benefit from faster delivery. They are time-sensitive and often bought with urgency. In such cases, express shipping helps you avoid value erosion and improves customer satisfaction. On the other hand, for basic items such as home goods, small accessories, or everyday consumables, economy shipping is more cost-efficient and acceptable to buyers.

Second, customer expectations differ widely. Some Tier 3 customers are perfectly fine waiting four to five days for delivery, especially if it helps bring down the total cost. But if you are noticing rising complaints or delayed delivery support queries, it might be time to reconsider your default shipping speed.

Third, your business margins matter. If you are in the early stages or operating with tight budgets, consistently opting for express delivery can drain your profits. Offering it as an optional paid upgrade is a smarter alternative.

Seasonality also impacts this decision. During peak shopping periods like Diwali or Eid, faster delivery boosts conversions. In slower seasons, it is better to switch to the economy to preserve working capital.

That is why many successful D2C brands now adopt a hybrid model. They segment orders based on geography, order value, and payment type. Express is auto-assigned to prepaid, high-value, or repeat orders, while economy is used as the default. Data from past RTO trends also helps fine-tune the approach. This strategy ensures brands deliver speed where it matters and save costs where it does not.

How 3PL Partners and Automation Are Powering Smarter Shipping

As e-commerce demand spreads deeper into Tier 2 and 3 India, logistics is no longer just about getting parcels from point A to B. It is about scale, speed, and accuracy in markets with unpredictable road conditions, inconsistent addresses, and wide-ranging consumer expectations.

This is where third-party logistics providers and shipping aggregators have become essential partners for D2C brands and small businesses.

- Multi-Courier Access Through One Platform: Third-party logistics platforms like Shiprocket, Pickrr, NimbusPost, Delhivery, and others allow D2C brands to manage multiple courier partners from a single dashboard. This gives sellers more flexibility and better reach across regions.

- Rate Comparison and Service-Level Automation: Sellers can compare shipping rates across carriers and set rules to auto-assign couriers based on delivery speed, price, or pin code success rates. This reduces manual errors and saves time on every shipment.

- Real-Time Tracking and Branded Experience: These platforms provide real-time tracking with branded tracking pages, improving visibility for both the seller and the customer. This helps reduce anxiety about delays, especially in remote areas.

- Automated NDR and RTO Management: When deliveries fail, automated workflows (like IVR calls or WhatsApp messages) are triggered to confirm address availability or reschedule delivery. This reduces RTOs and ensures follow-ups happen without manual intervention.

- COD Handling and Cash Reconciliation: In COD-heavy regions, these systems help verify the order before dispatch. They also manage cash reconciliation, allowing sellers to track collections accurately and maintain healthy cash flow.

- Stronger Pin Code Intelligence: Platforms use historical delivery data to flag risky or delay-prone pin codes. This helps sellers make better decisions about which shipping method to use in each location.

- Simplified Returns and Reverse Logistics: Returns are managed with better pickup scheduling and tracking, even in Tier 3 locations. This creates a more reliable experience for buyers and reduces operational friction for sellers.

Bottom Line

The future of e-commerce in India is rooted in Tier 2 and 3 cities. These markets are growing fast, but they demand a logistics strategy built on trust, flexibility, and efficiency. Sellers who understand local challenges and adapt their shipping models accordingly will gain a serious competitive edge.

To scale successfully, brands must look beyond just choosing express or economy shipping. The real advantage lies in automation, data, and smart partnerships. Platforms like Base.com, with over 1500 integrations across shipping, payments, returns, CRM, and warehousing, give sellers a unified system to manage the entire post-purchase journey.

With Base.com, brands can sync order data, auto-assign couriers based on pin code performance, reduce RTOs through verified workflows, and give customers consistent tracking and communication. Sellers also gain access to analytics that show what works in each region, allowing smarter decisions in real time.

As reverse logistics, COD demand, and regional buying patterns continue to evolve, integrated tools will become non-negotiable. The brands that win in Tier 2 and 3 India will be the ones that combine local sensitivity with strong backend systems. With the right foundation, logistics becomes not a cost center but a growth driver.

Click here, to know more about picking & packing errors that are eroding your profits.

Frequently Asked Questions

1. What is the best way to reduce RTOs in Tier 2 and 3 cities?

To reduce RTOs, use automated order confirmation via WhatsApp or IVR, segment risky pin codes, and prioritize prepaid orders with verified addresses. Offering real-time tracking and communicating delays proactively also helps build trust and reduce refusal or cancellation at the doorstep.

2. Should I offer express delivery in smaller towns?

Yes, but selectively. Offer express delivery for prepaid or high-value orders where speed matters. For low-value or COD orders, economy shipping may be more practical. Use data from past orders to identify where fast shipping improves conversions and where it adds unnecessary cost.

3. How do I choose the right logistics partner for non-metro areas?

Choose a logistics aggregator or 3PL with strong regional coverage and pin code intelligence. Look for partners offering automated courier allocation, NDR workflows, COD support, and return management. Integration with your existing tools via platforms like Base ensures better control and scalability.