Every e-commerce seller in India knows the thrill of seeing a new order notification pop up. But that excitement can quickly turn into frustration when the same order bounces back as a return. Returns are no longer rare, they are part of the Indian buying culture, especially in fashion, electronics, and COD heavy segments. Yet, for sellers, every return triggers a ripple of hidden costs and operational headaches.

Reverse logistics often costs more than forward shipping, squeezing already thin margins. COD refusals and fake addresses fuel high return to origin rates, leaving sellers to pay for both delivery and pickup.

Meanwhile, products stuck in the return pipeline distort inventory counts, causing overselling or stockouts. Add to this the labor of inspecting, grading, and restocking items along with fraudulent returns or policy misuse, and the pain becomes clear. Returns can feel like chaos, but with the right system, they can also unlock trust and growth.

Why Returns Are Rising in Indian E-Commerce

For D2C brands in India, returns are not just a customer right but a recurring pain point that cuts into margins, disrupts inventory flow, and strains customer relationships. Returns are no longer rare in the Indian market, they have become part of the buying culture.

Categories such as fashion, footwear, and electronics face the highest pressure, with fashion sellers often dealing with return rates between 25 and 40 percent due to sizing or color mismatches. Footwear brands also see customers ordering multiple sizes and sending back the ones that do not fit. Electronics brands encounter dead on arrival complaints or warranty-based returns, where customers send products back within weeks of purchase.

These challenges force sellers to bear high reverse logistics costs, blocked inventory, and customer dissatisfaction, making returns one of the most complex hurdles in scaling a D2C business in India.

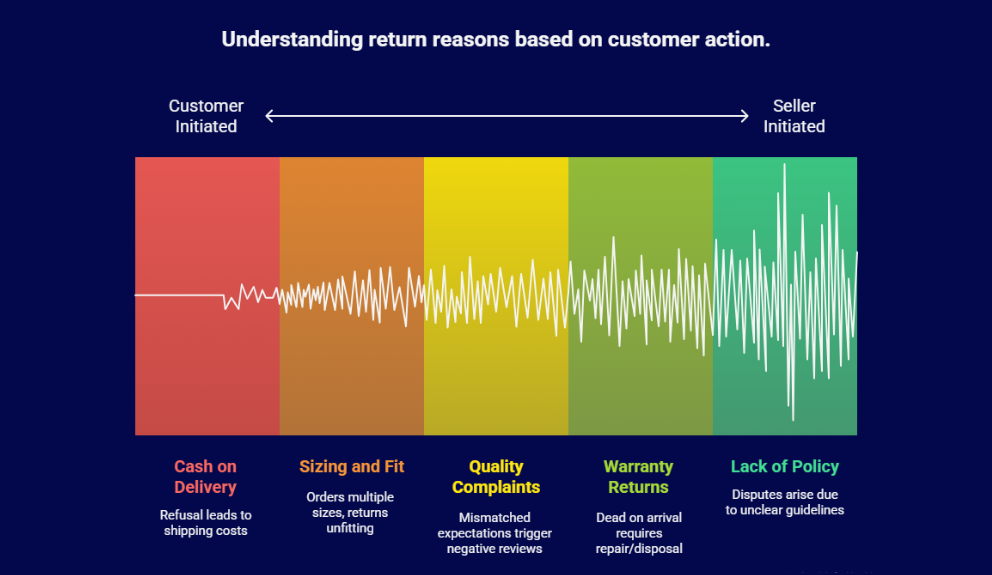

Factors driving high returns include:

- Cash on Delivery (COD) Returns: COD is still the most popular payment mode in India, especially in Tier 2 and Tier 3 cities. While it boosts order volumes, it also leads to high refusal rates. Customers often place impulsive orders “just to try” and then refuse delivery, leaving sellers to bear both the forward and reverse shipping charges.

- High Return to Origin (RTO) Costs: Each RTO drains working capital as sellers pay courier partners without recovering revenue. For small-ticket items, the logistics cost sometimes exceeds the profit margin, making every RTO a loss-making transaction.

- Sizing and Fit Issues: Fashion and footwear brands suffer the most here. Customers frequently order two sizes of the same product and return the one that does not fit. This blocks inventory, adds to warehouse workload, and increases inspection and repackaging costs.

- Quality Complaints and Wrong Deliveries: Many D2C brands rely on multiple suppliers or contract manufacturers. Variations in fabric quality, finishing, or packaging often lead to mismatches between customer expectations and actual delivery. These complaints not only increase return requests but also trigger negative reviews that damage the brand image.

- Warranty and Electronics Returns: Electronics and accessories brands face dead on arrival claims or warranty-driven returns. These are costly to process and often cannot be resold as new. Handling them requires inspection, repair, or disposal, which eats into margins.

- Lack of Clear Returns Policy: Without a transparent and well-communicated returns policy, disputes rise. Customers demand refunds even when exchanges should apply. This creates friction, consumes support bandwidth, and reduces customer trust.

- Inventory and Cash Flow Disruptions: Products stuck in the return pipeline are not available for resale, leading to overselling or artificial stockouts. Cash flow is also disrupted since refunds are processed before the product is restocked or resold.

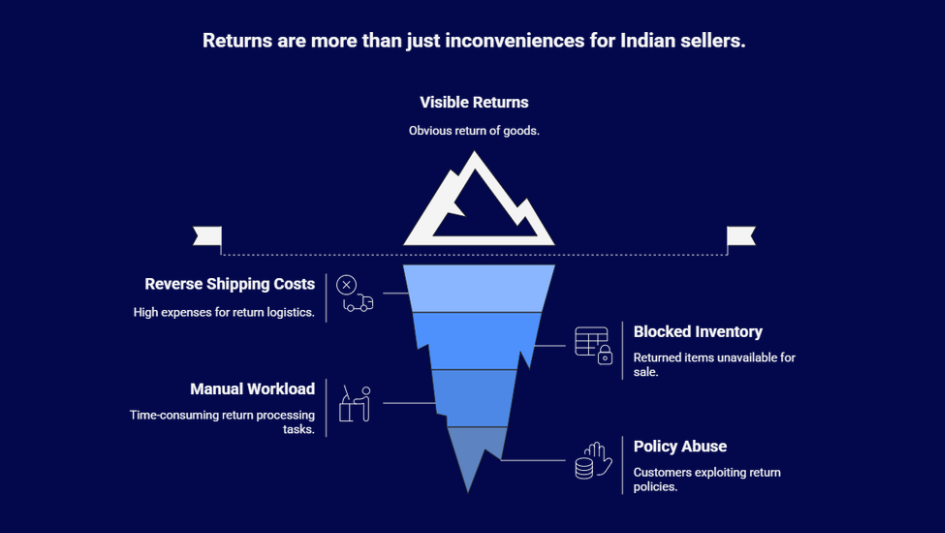

Why Do Returns Hurt Indian Sellers the Most?

For Indian sellers, especially small and mid-sized D2C brands, returns are more than an operational inconvenience, they directly eat into already thin margins. Each return sets off a chain of hidden costs and inefficiencies that most businesses underestimate until they scale. Let’s break them down in detail.

- Cost of Reverse Shipping

Reverse logistics in India often costs the same or more than forward delivery. For low-margin products priced under ₹500, a single return pickup can wipe out any profit. Sellers not only lose the sale but also pay couriers for moving goods back into their warehouse.

- Blocked Inventory

A returned item does not instantly re-enter stock. It sits in transit or at a return processing zone until inspected, graded, and repackaged. During this period, it is invisible to customers who may want to buy it, creating artificial stock-outs and missed sales opportunities.

- Manual Workload

Sellers who lack automation spend hours reconciling returns, updating stock, processing refunds, and handling customer queries. For a small team, this workload is unsustainable and pulls focus away from sales and growth activities.

- Policy Abuse and Fraud

Some customers exploit return policies. Fashion sellers often face “wardrobing,” where buyers wear clothes once for an event and send them back. Electronics brands report cases of customers returning used, damaged, or even swapped items while claiming they are defective. This leads to disputes and revenue leakage.

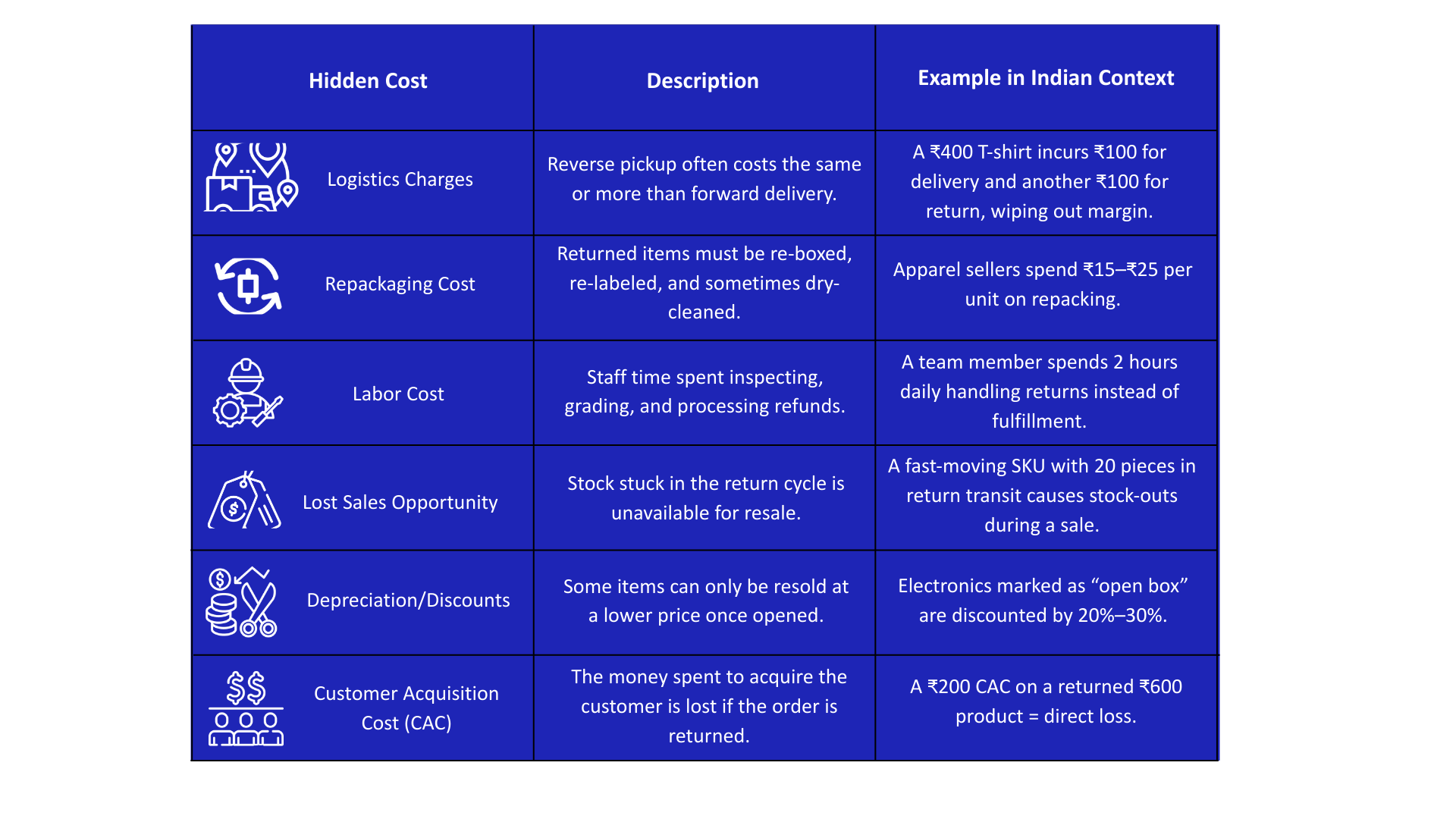

Table: Hidden Costs of Returns for Indian Sellers

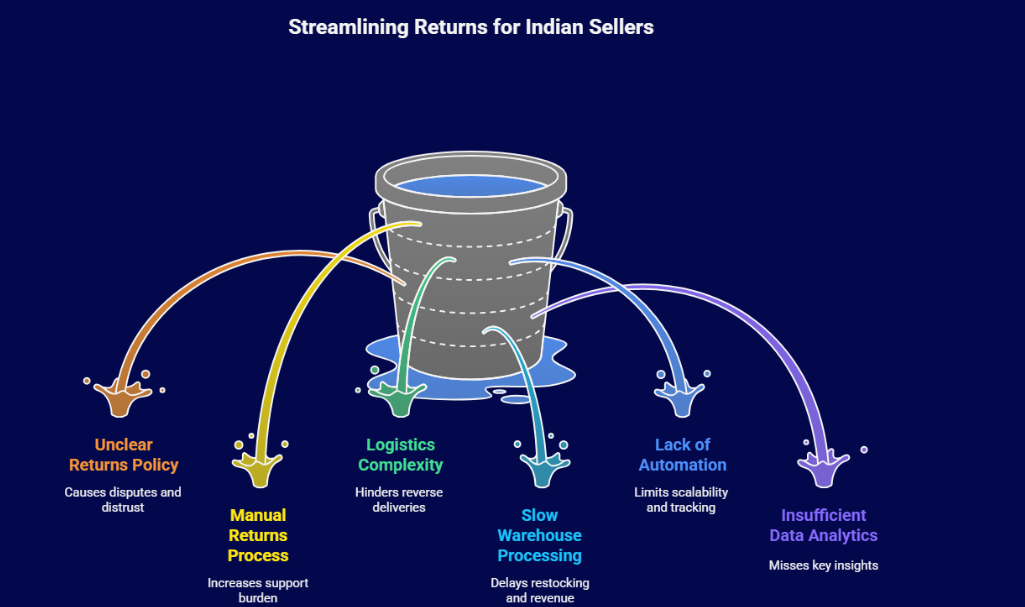

Building Blocks of a Seller Friendly Returns System

Returns may feel like a burden, but Indian sellers who put the right building blocks in place can turn them into a manageable and even strategic part of their business. Based on real challenges faced by D2C brands, here are the core components of a seller friendly returns system.

1. Clear and Transparent Returns Policy

The foundation of any efficient returns system is a clear, easy to understand policy. Sellers should avoid lengthy legal text and instead highlight the essentials such as how many days customers have to return (7 days, 15 days, or 30 days), what reasons are acceptable (defects, wrong size, wrong product), and whether refunds or exchanges apply. Policies should also vary by category. A fashion brand may allow size based exchanges, while electronics may focus on warranty backed returns. Clarity prevents disputes, builds trust, and sets the right expectations from the start.

2. Returns Portal and Self Service Tools

Customer frustration increases when returns require long email threads or phone calls. A self service returns portal gives customers the ability to initiate requests on their own, choose pickup slots, and track status. This reduces the burden on support teams and speeds up the process. Automated status updates such as “pickup scheduled,” “item received,” or “refund processed” keep customers informed and reduce complaint tickets.

3. Integrated Reverse Logistics Partners

Managing pickups across India’s diverse pin codes is a major challenge. Sellers need logistics partners that specialize in reverse deliveries and cover both metros and Tier 2 or 3 cities. Using bulk pickup or hub drop models can significantly reduce costs, especially for lower value items. Integration between logistics partners and seller systems ensures real time updates on pickups, tracking, and delivery of returned items.

4. Warehouse Returns Processing

Once an item comes back, speed and accuracy are critical. Sellers should dedicate a specific area in the warehouse for returns. At this stage, teams inspect, sort, and grade items into restockable, refurbishable, or scrap categories. This prevents damaged or unsellable items from mixing with fresh inventory. Automating stock updates ensures restockable items are visible for sale quickly, preventing revenue leakage caused by ghost inventory.

5. Technology and Automation

Manual handling of returns is unsustainable as order volumes grow. By integrating order management, warehouse, and finance systems, sellers can create a seamless process where refunds trigger automatically after inspection, and inventory adjusts in real time. Automation also allows tracking of SKU level return rates, helping brands identify problematic products. For example, if a particular style of shoe consistently sees high returns due to fit issues, the brand can adjust size charts or remove the SKU entirely.

6. Data Analytics

Returns provide valuable insight into both products and processes. By collecting granular data such as reasons for return, customer profiles, and frequency, sellers can identify patterns. Products with high return rates may need better descriptions, improved quality control, or supplier changes. Analytics can also highlight operational inefficiencies such as slow refund processing, which affect customer satisfaction. Using this data, sellers can negotiate with suppliers, optimize their catalogs, and reduce return percentages over time.

The Reverse Logistics Process: Step by Step Guide

Reverse logistics can look different depending on your business model, but most sellers will experience a similar cycle. Here is how the process typically unfolds:

Step 1: Initiating the Return

The return process begins when the customer requests to send back a product. This may happen through an online returns portal, a mobile app, or by contacting customer service. At this stage, the system should capture not just the return request but also the reason behind it. These reasons such as wrong size, defective product, or simply changed my mind are valuable for future analysis. A smooth initiation process reassures customers that they are being taken care of, while businesses gain structured data to improve products and policies.

Step 2: Product Collection

Once approved, the product needs to be physically collected. Customers may schedule a pickup through a courier partner, or drop off the product at a designated return center, retail store, or locker. Efficient collection is critical because delays here can create frustration. For sellers, ensuring wide coverage across Tier 2 and Tier 3 cities is especially important, since customers in these areas expect the same convenience as metro buyers.

Step 3: Inspection and Sorting

After collection, returned items are transported to a warehouse or return center for inspection. This stage determines the product’s condition and the next course of action. Products are graded as restockable, refurbishable, recyclable, or scrap. Without accurate inspection, unsellable goods might get mixed with fresh inventory, or perfectly good items may be discarded which creates avoidable losses.

Step 4: Repair or Refurbishment

Products that are defective but salvageable go through repair or refurbishment. This may involve replacing faulty parts, cleaning, repackaging, or labeling the item as open box. Refurbished products can be sold at a discount or through alternative channels. This step is critical for value recovery, as it turns potential losses into revenue streams.

Step 5: Restocking or Disposal

Finally, restockable items are quickly added back into the inventory system to avoid artificial stock outs, while unsellable items are disposed of responsibly. Sellers aiming for sustainability often partner with recyclers or eco friendly disposal providers. The faster this stage is executed, the lower the cost impact of returns.

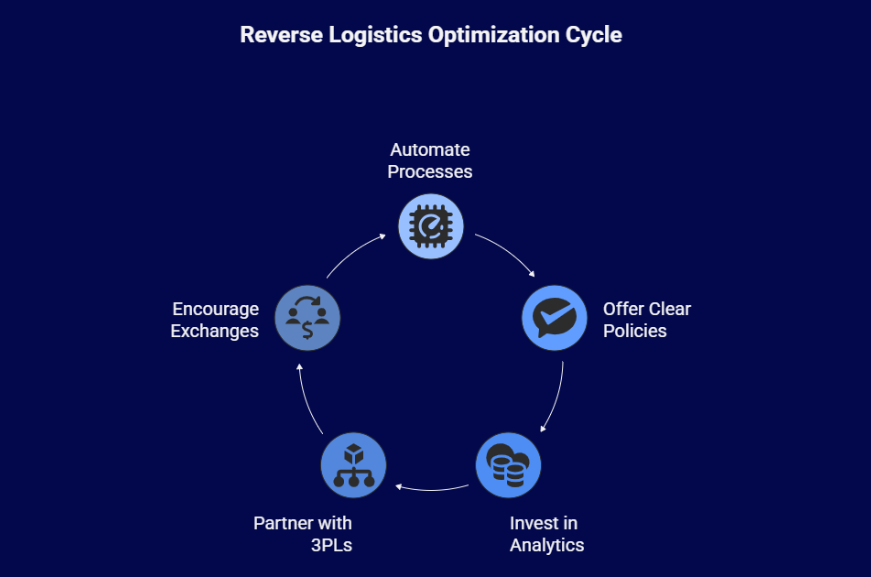

Strategies to Improve Reverse Logistics

Having a process is not enough, businesses must constantly optimize reverse logistics to minimize losses and improve customer satisfaction. Here are five strategies explained in depth:

1. Automate Where Possible

Manual returns handling creates errors and delays. Businesses can deploy smart return portals that auto generate labels, assign courier pickups, and sync with warehouse management systems. Automation speeds up inspection, restocking, and refund processes. For example, an apparel brand can automate SKU tagging to immediately send size related returns back into stock once inspected.

2. Offer Clear Return Policies

Ambiguity in return timelines or conditions frustrates customers and overwhelms support teams. A clear, concise policy visible on product pages and at checkout sets expectations early. Differentiating policies by category such as exchanges for apparel and warranty claims for electronics prevents disputes. Clarity reduces cart abandonment and builds long term trust.

3. Invest in Analytics

Every return carries data such as why it happened, how often it occurs, and which products are most affected. By analyzing these insights, sellers can pinpoint problem SKUs, fix quality issues, and even refine product descriptions. For instance, if a footwear line sees repeated returns due to sizing, updating the size guide can significantly reduce return rates.

4. Partner with 3PLs

Third party logistics providers bring scale and expertise to reverse logistics. They offer pickup coverage across India, manage regional return hubs, and handle international returns seamlessly. For D2C brands, outsourcing this complexity to logistics partners helps save costs and ensures returns are processed faster without overburdening in house teams.

5. Encourage Exchanges Instead of Returns

Exchanges help sellers retain revenue while still keeping customers satisfied. For instance, if a shirt does not fit, encouraging the customer to swap for another size avoids refund outflow and preserves the sale. Incentives such as free exchange shipping or small store credits can nudge customers toward this option, reducing restocking hassle.

Final Thoughts: India-Specific Strategies for Reverse Logistics

Returns are unavoidable in Indian e-commerce, but smart strategies can make them manageable and even profitable. One effective approach is to reduce COD dependence by encouraging prepaid payments. Offering small UPI based discounts not only builds customer loyalty but also cuts down on return to origin rates, which remain one of the biggest drains for sellers.

Regional hubs in cities like Delhi, Mumbai, and Bangalore speed up both deliveries and reverse transit, ensuring faster inspection and restocking. Secondary sales channels such as refurbished or open-box platforms allow sellers to recover value from items that cannot be sold as new, instead of absorbing total losses. Finally, sustainability is no longer optional. Partnering with recyclers for unsellable or electronic items helps brands stay compliant with environmental regulations and improve their reputation with eco conscious customers.

This is where a technology partner like BaseLinker becomes essential. BaseLinker integrates orders, returns, inventory, and logistics into one unified system. Sellers can track reverse pickups, automate warehouse inspection flows, and connect with courier and resale channels seamlessly. By consolidating operations, BaseLinker reduces manual workload, prevents ghost inventory, and helps Indian D2C brands turn returns from a cost center into a customer trust builder.

Click here to know more about how the future of shipments in Tier-2/3 India is shaped by the balance between express delivery and cost-effective options.

Frequently Asked Questions

1. How do I reduce COD return to origin (RTO) orders in India?

COD RTOs can be reduced with order confirmation calls or WhatsApp, small prepaid booking fees, and UPI-based discounts. Incentivizing prepaid payments and verifying addresses before dispatch helps sellers cut RTO rates significantly and protect margins.

2. What happens to products after they are returned by customers?

Returned products are inspected, graded, and sorted. Restockable items go back into inventory, defective ones are refurbished or sold as open-box, and unsellable products are recycled or disposed of responsibly. This process ensures value recovery and minimizes waste.

3. Why does reverse logistics cost more than forward shipping in India?

Reverse logistics is complex and unpredictable. Couriers must collect from dispersed addresses, shipments are irregular, and inspection adds overhead. Unlike bulk forward shipping, returns lack scale, making pickup, transport, and handling costs often higher than original delivery charges.