If you’ve ordered groceries or that one forgotten ingredient online recently, and it arrived in under 30 minutes, you’ve experienced the quiet revolution happening just around your corner. This isn’t just fast delivery; it’s a profound logistical transformation powered by micro-warehouses and dark stores.

For too long, e-commerce relied on big, impersonal warehouses out near the highway. That model works for bulk deliveries, but it fails miserably when you need something now. India’s quick commerce boom, fueled by a booming digital economy that’s now spreading across Tier 1 and even into ambitious Tier 2 cities, has made the old way obsolete. Companies are now creating a dense, almost invisible network of small fulfillment centers, getting inventory right into your neighborhood. The goal? To crush the last-mile delivery time and redefine convenience.

What’s Really Behind This Need-for-Speed Addiction in Indian Consumers?

Let’s be honest, our patience has shrunk in direct proportion to our reliance on digital convenience. The massive increase in online shopping, especially for high-frequency goods like groceries and daily essentials, has fundamentally changed what we expect from delivery. It’s no longer enough for an item to arrive tomorrow; the expectation has moved aggressively into the sub-30-minute window.

This shift isn’t just about consumer impatience; it’s about smart business strategy. Placing a dark store in a dense urban area isn’t magic; it’s mathematical efficiency. It drastically reduces the physical delivery journey, which means less fuel burnt, less time wasted in traffic, and ultimately, a happier customer who is more likely to order again. This increased last-mile efficiency is the financial backbone of the entire quick commerce movement. The ability to guarantee rapid service is now the single most powerful competitive differentiator in the market.

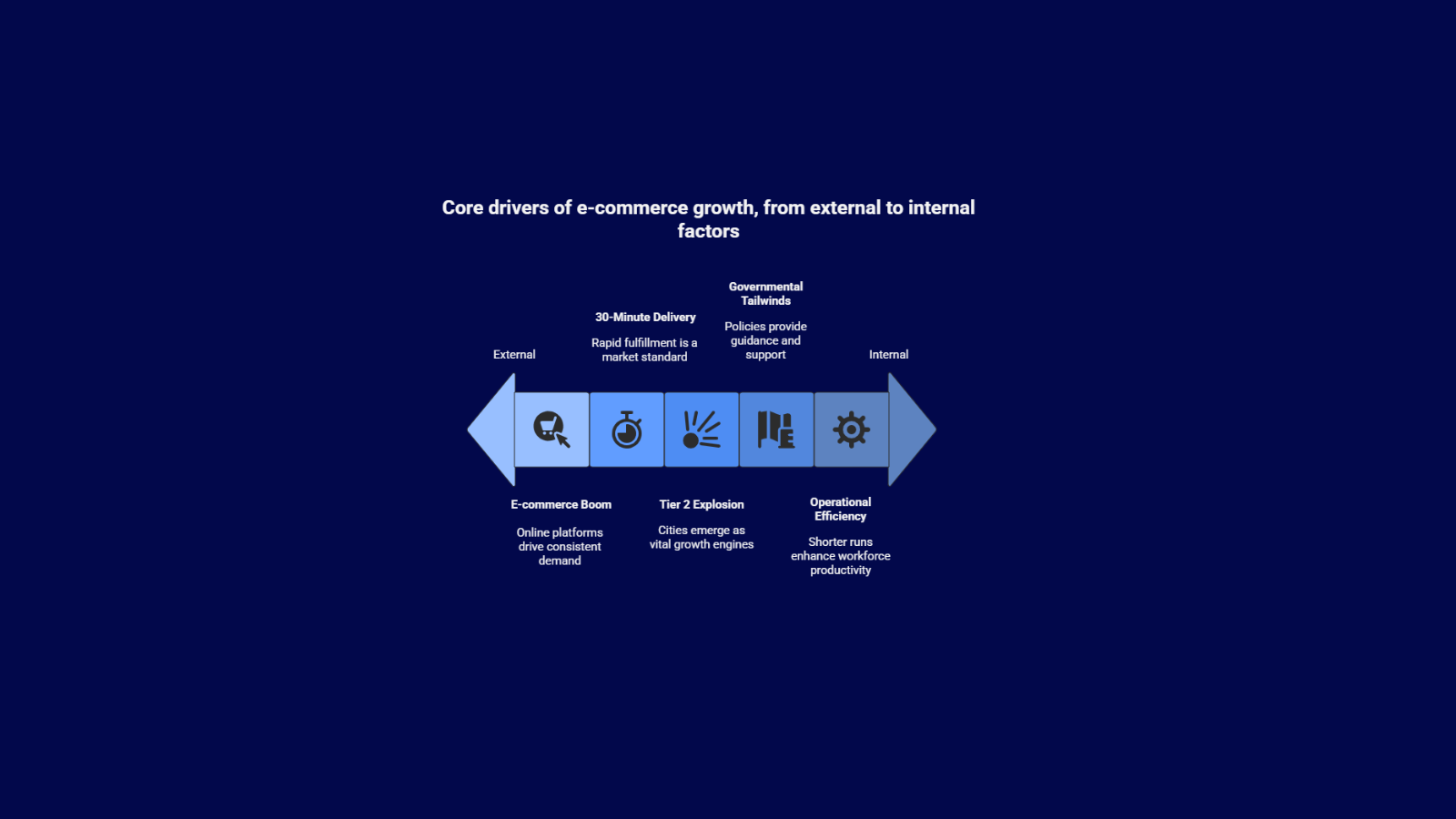

The Five Core Drivers We Can’t Ignore

The growth isn’t accidental; it’s strategic and systemic. It represents a mature response to evolving market dynamics:

- The E-commerce and Quick Commerce Boom: Widespread adoption of online platforms has generated an enormous and consistent baseline demand for rapid-delivery items, fundamentally changing retail volume distribution.

- The 30-Minute Expectation: Consumers now actively choose platforms that promise rapid fulfillment, prioritizing delivery speed above nearly all other service attributes, thereby establishing the market standard.

- Operational Efficiency: Shorter delivery runs directly enhance the productivity of the delivery workforce and optimize resource allocation, reducing the marginal operational cost per delivery run.

- The Tier 2 Market Explosion: Fueled by rising digital penetration and increasing disposable incomes, cities like Jaipur, Coimbatore, and Nagpur are emerging as vital growth engines and crucial battlegrounds for new market share.

- Governmental Tailwinds: Proactive policies like the National Logistics Policy (NLP) 2022 are providing formal guidance and strategic support, with state governments working to ease approvals to accelerate the development of this modern logistics infrastructure.

-

Old Model Focus (Regional Center) New Model Focus (Micro-Warehouse) Economic Rationale for the Change Bulk Storage High-Rotation Inventory Reduces capital tied up in slow-moving stock and maximizes throughput. Slow, Scheduled Delivery Immediate, Sub-30 Minute Delivery Increases customer lifetime value and reduces churn through superior service. Low Urban Density High Urban Density (Hyperlocal) Minimizes last-mile travel time and associated variable costs (fuel, time).

What Does a Dark Store Actually Look Like, and How Does it Change Our Cities?

If you were to peek inside a dark store, you wouldn’t see shelves designed for shoppers; you’d see a facility engineered for speed. It’s a retail space that has gone completely non-customer-facing, hence the name “dark.” It is a dedicated hub for rapid fulfillment, prioritizing order processing over all else.

1. Revitalization of Underused Urban Spaces

For years, cities across India have carried a silent burden of vacant or underperforming commercial properties. Old retail shops that could not compete with modern storefronts, basements that lacked visibility, and ground floor units that remained idle for long stretches. Dark stores have breathed new life into these forgotten spaces. Because they do not require attractive interiors or street frontage, they are ideal tenants for such locations.

A property that was once a loss for its owner becomes a high-performing logistics hub, generating consistent revenue and creating new purpose within the neighborhood. This revitalization has a multiplier effect. When economic activity returns to a lifeless stretch of urban space, nearby properties often see improved interest and value as well. In short, dark stores act as catalysts for micro urban renewal, turning neglected corners into productive, service-oriented zones.

2. Rise in Flexible Gig Employment

The dark store model relies heavily on the gig economy, especially through delivery partners who form the bridge between the fulfillment center and the doorstep. This growing demand has opened up flexible employment options for thousands of workers who need part-time or on-demand income. Students, migrants, and workers seeking supplementary earnings now have a reliable way to participate in the digital retail boom.

The flexibility of these roles is a key attraction. Workers can choose their shifts, decide their hours, and balance multiple responsibilities without being tied to a rigid schedule. While the debate on income stability and worker rights continues, there is no denying that dark stores have become powerful engines for job creation. They have expanded the definition of urban employment and made last-mile logistics one of the fastest-growing service sectors in India.

3. Shift in Urban Real Estate Dynamics

Dark stores have altered the rules of urban real estate. Traditionally, demand centered around large retail showrooms or corporate offices. The new gold mine is compact, well located ground floor units that can handle fast inventory movement and easy dispatch. This has pushed up the value of properties in dense residential clusters, where dark stores generate the highest efficiency.

Landlords who once struggled to rent smaller spaces now find themselves in competitive negotiations. Cities are witnessing a clear redistribution of commercial demand, moving away from glamorous high street retail toward functional micro logistics hubs. This shift is forcing real estate developers and city planners to reassess zoning practices, infrastructure allocation, and the future shape of mixed use neighborhoods.

4. Greater Access and Convenience for Consumers

Dark stores have redefined what convenience means for urban Indians. The promise of rapid delivery for groceries, medicines, personal care items, and daily essentials has raised the bar across the board. Consumers no longer plan purchases days ahead.

They expect near instant access. This shift in behavior has empowered households, especially working professionals and families that juggle tight schedules. It also levels the playing field between larger cities and growing Tier 2 markets, where dark stores are rapidly expanding. The ability to receive essentials within minutes is becoming a standard service expectation, not a premium offering.

5. Integration of Technology into Daily Urban Life

The dark store ecosystem runs on intelligence built into routing algorithms, inventory forecasting systems, and demand prediction models. This constant reliance on data deepens the role of technology in everyday life. Consumers interact with apps more frequently. Delivery partners depend on navigation tools.

Operators use software to measure efficiency at every step. As this model grows, cities themselves begin to function in a more tech enabled rhythm. Dark stores accelerate the digital maturity of both businesses and citizens, strengthening India’s overall urban tech infrastructure.

The Societal Impact of the Model is Tangible:

- Urban Revitalization: Conversion of dormant commercial space into productive economic hubs.

- Gig Economy Growth: Providing essential flexible employment to meet last-mile needs.

- Consumer Empowerment: Setting new, higher standards for urban access and convenience.

But Can This Expansion Sustain Itself Against Real-World Hurdles?

The speed and scale of this expansion, while impressive, introduce practical friction points. We cannot discuss this growth without acknowledging the inherent challenges that test the viability and scalability of the model.

Key Challenges Facing Dark Stores in India

| Challenge | Description | Impact on Operators |

| Real Estate Constraints | The dark store model depends on hyperlocal placement in dense, high demand urban areas. These zones are already saturated, which makes suitable properties hard to find and costly to secure.

Competition for small but strategically located commercial spaces is rising fast and is pushing leasing costs even higher. Operators must work through complex trade offs between ideal placement and affordability. The search for the perfect pin drop location has become the single largest barrier to entry. |

Higher leasing costs, tighter margins, slower rollout of new locations, increased pressure on unit economics. |

| Regulatory Hurdles | Rapid expansion has outpaced urban planning and existing law. Many areas follow zoning classifications that were never designed for small logistics hubs that operate around the clock.

This creates ambiguity around compliance, approvals, and usage rights. Companies must navigate unclear or outdated regulations, which increases risk and can trigger delays or local opposition. Clear and updated rules are needed for smooth growth across Tier 1 and Tier 2 cities. |

Compliance delays, regulatory risk, potential location shutdowns, obstacles to scale, community friction. |

The two main roadblocks require strategic, long-term solutions:

- Urban Real Estate Scarcity: The intense demand for limited 600-1,200 sq. ft. commercial units in high-footprint, strategic urban zones drives up leasing costs and creates fierce competition.

- Regulatory Classification: Lack of clear legal classification for a “dark store” under existing zoning laws (Is it retail, warehouse, or distribution?) creates uncertainty and compliance risks for operators.

Conclusion: The Future is Hyper-Local and Ultra-Fast

The trajectory of logistics in India is undeniably heading toward hyper-locality. The micro-warehouse and dark store model is not a temporary trend but a fundamental re-engineering of the retail supply chain, built around the core consumer expectation of speed and convenience.

While substantial hurdles remain, particularly in navigating complex urban real estate and ensuring regulatory compliance, the economic incentives, driven by consumer demand and last-mile efficiency, are too powerful to ignore. As e-commerce deepens its penetration into both Tier 1 and Tier 2 cities, these small, strategically placed fulfillment centers will only become more critical, serving as the essential engines for India’s quick commerce revolution and its burgeoning gig economy. The future of Indian retail is being delivered, one short mile at a time, from these small but powerful urban hubs.

Ready to Build Your Quick Commerce Network?

If you’re looking to strategically place your next micro-warehouse in a prime Tier 1 or Tier 2 urban location to dominate the sub-30-minute delivery race, securing the right real estate is the critical first step. Get expert logistics real estate consultation and secure your essential urban footprint today at Base.com.

Click here to read more about the ways fast-growing D2C brands are using tech to compete with marketplaces?

Frequently Asked Questions (FAQ)

1. What is the biggest difference between a “dark store” and a regular retail store?

The key difference is access and purpose. A dark store is designed as a specialized micro-fulfillment center that is closed to the public. Its sole function is to serve as a high-speed logistics hub, with staff dedicated only to quickly picking and packing online orders for delivery, making it an efficient engine, not a consumer shopping destination.

2. Does the government support this quick commerce logistics model?

Yes, the Indian government has recognized the efficiency and economic potential of this model. The National Logistics Policy (NLP) 2022 is structured to promote and formalize urban logistics infrastructure, which includes micro-warehouses. Additionally, state-level policies are often being modified to offer support, particularly by aiming to expedite the necessary approvals for setting up these time-sensitive operations.

3. Why is expansion into Tier 2 cities so important right now?

Tier 2 cities like Coimbatore and Nagpur are experiencing rapid increases in both digital literacy and disposable income, positioning them as the next frontier for quick commerce market growth. Expanding into these markets allows companies to secure first-mover advantage and diversify their customer base, tapping into millions of new potential consumers who are actively adopting online shopping for daily necessities.