If you’re running a Direct-to-Consumer (D2C) brand in India right now, you know the retail game has fundamentally changed. We’ve moved past waiting a couple of days for delivery; the urban Indian consumer today expects instant gratification. This massive shift is being driven by Quick Commerce (QC), a hyper-local logistics model promising everything from a quick snack to a last-minute essential delivered in minutes, we’re talking 10 to 30 minutes, tops. It’s all about capturing that sale the very moment the impulse or need strikes.

For a D2C brand, which thrives on being nimble and having a direct line to the customer, quick commerce isn’t just an optional addition; it’s fast becoming an essential pillar of your growth strategy. It allows you to grab those impulse purchases, significantly boost your brand’s visibility in high-density areas, and encourage much higher purchase frequency. These platforms, powered by networks of small, local “dark stores” and clever logistics tech, are no longer just for groceries. They are powerful distribution engines, and knowing the key players is the absolute first step toward integrating profitably.

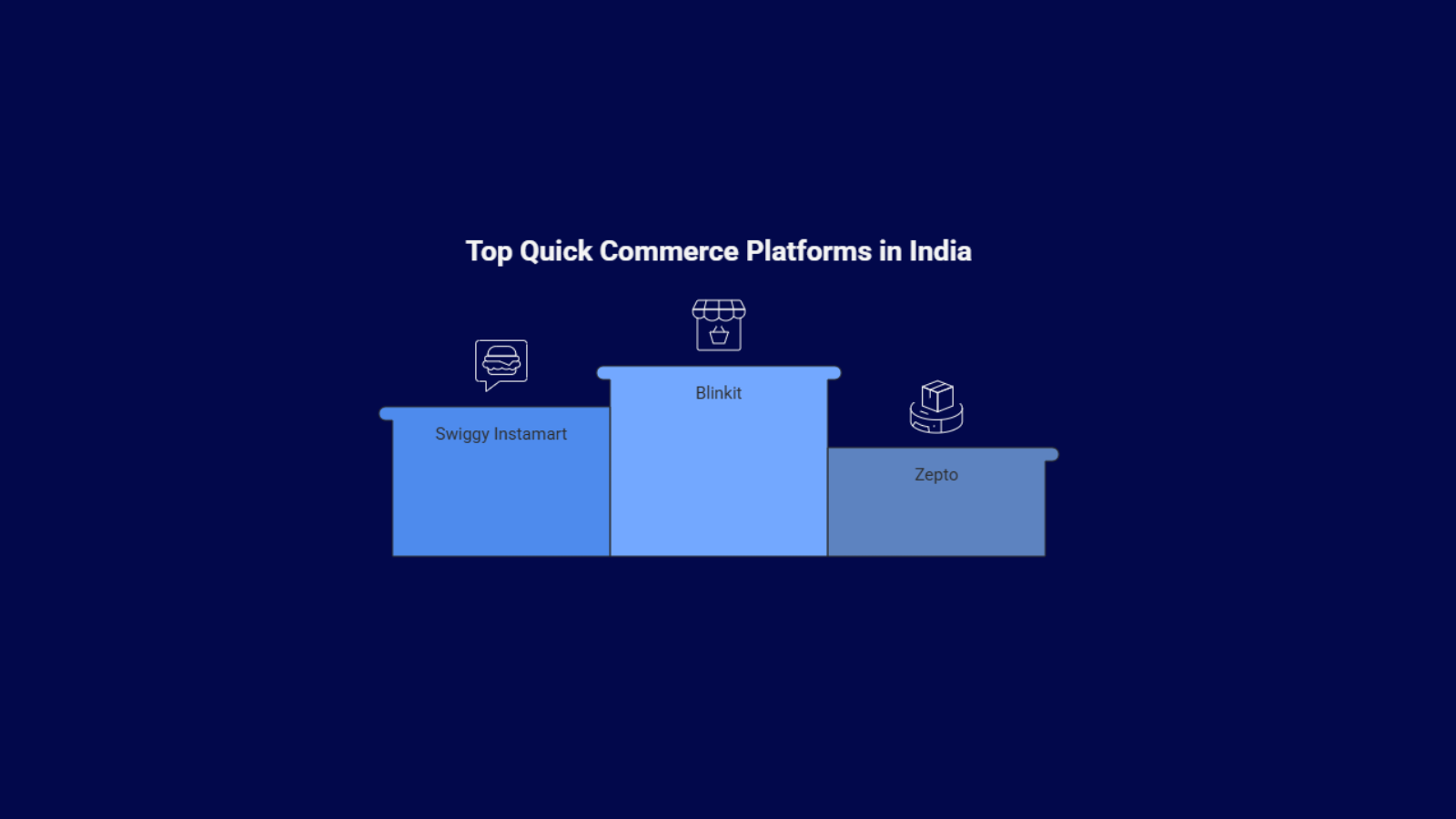

Who are the top 5 Quick Commerce platforms dominating the Indian market today?

When you decide to jump into the Quick Commerce space, you need to be strategic about your partners. These are the companies setting the speed limits, dictating commission norms, and, most importantly, holding the key to millions of consumers who demand speed. Choosing the right platform, or mix of platforms, is crucial for hitting your sales volume without eroding your margins.

The Indian QC landscape is currently defined by five major entities battling fiercely for market share. They are constantly investing heavily in infrastructure, tech, and marketing. As an Indian seller, partnering with these leaders is non-negotiable for achieving meaningful scale. Here are the top five, based on their operational influence and sheer market presence: Blinkit, Swiggy Instamart, Zepto, BigBasket (BB Now), and the recently emerged Flipkart Minutes.

1. Blinkit (Owned by Eternal)

Blinkit, which you might recall as Grofers, has firmly established itself as the Quick Commerce market leader. A large part of this dominance is thanks to the solid financial backing and ecosystem support it receives from its parent company, Eternal. This support gives them the resources to expand rapidly and diversify their product categories far beyond just food.

For D2C brands, Blinkit offers the largest, most active user base for quick transactions, meaning unmatched volume potential, especially for fast-moving items in the major metros where their dark store network is most concentrated.

| Pros for D2C Brands | Cons for D2C Brands |

| Market Leader Reach: You gain access to the biggest and most active user base in QC, providing excellent brand visibility and the scale necessary for high-volume sales. | High Commission & Fees: As the leader, Blinkit often charges premium commissions and listing fees, which can put serious pressure on your product’s net profit margin. |

| Ecosystem Synergies: The potential for cross-promotion and data insights from the wider Eternal ecosystem (like food delivery) gives you a richer, more contextual understanding of consumer behaviour. | Intense Competition: The platform is very crowded, making it difficult for smaller D2C brands to stand out without committing significant, ongoing advertising budgets. |

| Non-Grocery Expansion: Their strong push into categories like beauty, personal care, and electronics means great opportunities for a diverse range of D2C products. | Inventory Pressure: The demand for high-speed fulfillment means Blinkit requires near-perfect, real-time inventory accuracy in their dark stores, which can lead to high penalties if you have supply chain issues or stock-outs. |

To succeed on Blinkit, your D2C product needs to be a perfect fit for impulse purchasing, and your operations must be able to handle high volume even if the per-unit margin is tighter.

2. Swiggy Instamart

Swiggy Instamart is brilliant because it leverages the enormous strength of its parent, Swiggy, the food delivery powerhouse. It smartly uses Swiggy’s existing, highly efficient rider network and its huge, built-in customer base.

The major advantage here is user habit. Millions of people open the Swiggy app daily for immediate needs (food), making the move to ordering essentials on Instamart incredibly seamless. This established habit gives D2C brands immediate access to customers who are already comfortable with rapid digital transactions.

| Pros for D2C Brands | Cons for D2C Brands |

| Massive User Conversion: You benefit from the easy conversion of the vast Swiggy food delivery user base into quick commerce shoppers, offering immediate, high-volume exposure with low friction. | Focus on Groceries: Historically, the platform has a stronger bias towards core grocery and staples, making it potentially harder for niche, non-FMCG D2C brands to gain prominent visibility. |

| Operational Efficiency: Leveraging the existing, optimized rider network ensures fast, reliable dispatch times, reducing logistics friction significantly. | Geographic Constraints: While they are expanding quickly, their dark store network might not be as dense as the market leader’s in every single micro-market, potentially limiting the serviceable pin codes for your brand. |

| Promotional Tools: Access to a variety of proven in-app promotional and advertising slots within a continuously high-traffic app environment to drive quick product discovery. | Data Visibility: D2C brands usually receive less detailed customer behaviour data compared to their own direct channel, limiting your ability to build those crucial proprietary customer profiles. |

Brands partnering with Swiggy Instamart should align their product placement with the app’s natural user flow and use targeted advertising to convert Swiggy’s loyal user base into new, frequent customers for their brand.

3. Zepto

Zepto entered the market with an aggressive, tech-first strategy, effectively setting the standard for the 10-minute delivery model in India. They are highly respected for their technology, impressive operational consistency, and focused execution in specific urban clusters.

Zepto has successfully built a strong brand identity that appeals to a younger, more tech-savvy demographic, a valuable customer who is often willing to pay a premium for speed and is generally keen to try new, trending products. For a D2C brand, partnering with Zepto means aligning yourself with a platform deeply committed to logistical innovation and a superior customer experience.

| Pros for D2C Brands | Cons for D2C Brands |

| Logistics Innovation: Associating with a brand famous for speed and consistency inherently enhances your D2C brand’s image of reliability and efficiency. | Premium Pricing and Margins: The high cost of sustaining a consistent 10-minute delivery network sometimes requires them to take a higher margin cut from the D2C seller. |

| Young, Tech-Savvy Audience: Access to a valuable consumer segment that is highly engaged, open to new products, and frequently makes purchases based on convenience. | High Entry Barrier: They can be quite selective in their brand and product onboarding to maintain focus and efficiency, potentially excluding smaller, niche D2C players who don’t yet have proven demand. |

| Focused Inventory: A generally smaller, more curated product catalog in their dark stores can mean less digital shelf competition for your specific, well-chosen products. | Sudden Policy Changes: As an aggressive, fast-growing startup, their commercial and operational policies can sometimes shift quickly in response to market demands or competition. |

D2C brands should look at Zepto as the perfect channel to capture high-value impulse buyers, allowing them to use the platform’s guaranteed fast turnaround time as a powerful element of their product’s overall value proposition.

4. BigBasket (BB Now)

BigBasket is a market veteran in Indian e-grocery, and its Quick Commerce arm, BB Now, is a natural, credible extension of its long-established supply chain and trusted customer base. It benefits immensely from the institutional trust and stability provided by the Tata Group.

BB Now’s core strength comes from BigBasket’s reputation for quality sourcing, rigorous control, and an existing customer base accustomed to weekly, planned grocery shopping. For a D2C brand, this means you are tapping into a highly loyal, quality-conscious customer who is now also demanding speed. The Tata association adds a strong layer of credibility and customer confidence.

| Pros for D2C Brands | Cons for D2C Brands |

| Trusted Brand Heritage: Associating with the respected BigBasket name ensures immediate customer trust regarding product quality, sourcing, and delivery reliability. | Slower Scaling: The Tata-backed focus on stability and profitability might mean a slower, more cautious expansion of the QC network compared to the pure-play, aggressively funded startups. |

| Quality Control Advantage: Leveraging BigBasket’s robust cold chain and quality control infrastructure is a significant benefit for D2C brands dealing with perishable or sensitive products. | Category Overlap: BB Now operates alongside the main BigBasket platform, creating a potential internal competitive dynamic that D2C brands must carefully manage to avoid cannibalizing their existing, planned BigBasket sales. |

| Cross-Selling Potential: High likelihood of cross-selling from the main BigBasket platform’s high-basket-value users, encouraging planned purchases to be supplemented with immediate needs. | Legacy System Integration: Integrating your supply chain systems with the platform might be slightly more complex than interfacing with a completely new, purpose-built technology stack. |

Partnering with BB Now is a strong strategic choice for D2C brands that prioritize product quality and aim to serve a more established, loyal, and quality-conscious customer base, perfectly complementing their primary e-commerce strategy.

5. Flipkart Minutes

Flipkart Minutes signifies the powerful entry of the e-commerce titan, Flipkart, into the Quick Commerce segment. This move draws heavily on the company’s vast financial resources, proven technology platform, and existing national seller base.

Flipkart’s arrival is a clear signal of the market’s importance. D2C brands gain instant access to Flipkart’s enormous user base, who are already highly comfortable transacting on the platform for almost any product. The platform is expected to quickly integrate non-grocery categories, making it a vital channel for D2C brands in beauty, small electronics, and lifestyle goods.

| Pros for D2C Brands | Cons for D2C Brands |

| Massive User Base & Capital: Access to Flipkart’s huge customer base and the backing of a leading e-commerce player ensures rapid scale and sustained, high-budget promotional campaigns. | Initial Operational Instability: As a newer entrant focused on ultra-fast delivery, the platform may experience initial operational issues with dark store efficiency and consistently meeting aggressive delivery timelines. |

| Category Diversity Potential: There is a high likelihood of the platform quickly integrating non-grocery categories, offering D2C brands in niches like small electronics and fashion accessories a rapid-delivery channel early on. | Marketplace Overlap: Similar to BigBasket, there is a risk of sales cannibalization from the main Flipkart marketplace, requiring careful product differentiation and pricing strategy. |

| Seller Tools & Support: You get access to Flipkart’s established, comprehensive suite of seller tools, detailed analytics, and robust support infrastructure perfected over years on their main marketplace. | High Customer Acquisition Cost (CAC): The intense competition among all QC players, fuelled by Flipkart’s entry, could quickly lead to higher promotional spending requirements from D2C brands to secure and maintain visibility. |

D2C brands should closely monitor Flipkart Minutes and aim to be early adopters to secure favorable terms and high initial visibility, utilizing the platform’s aggressive launch phase to rapidly acquire new customers.

What are the overarching benefits of Quick Commerce for Indian D2C Sellers?

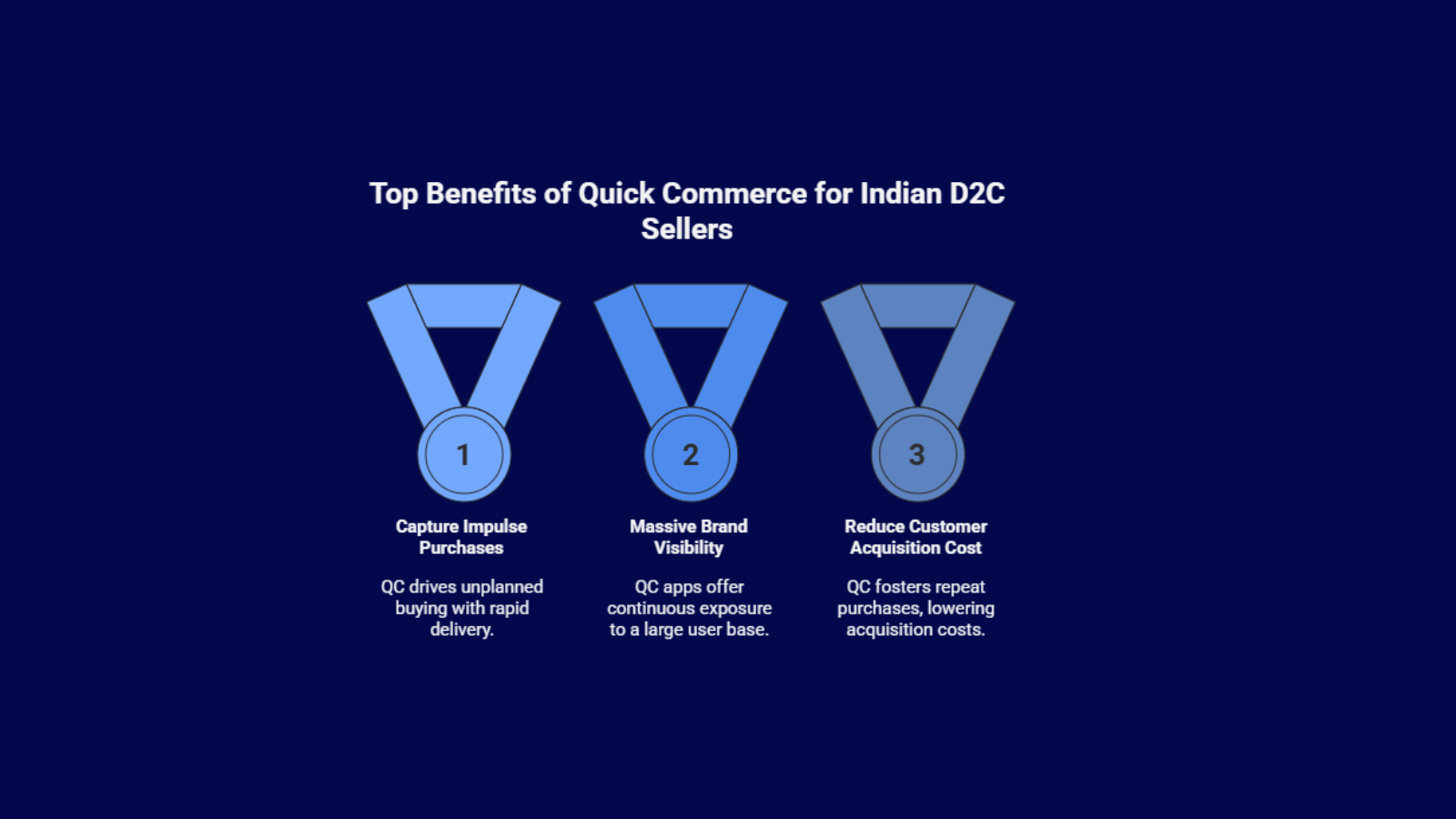

Quick Commerce provides D2C brands with a vital competitive edge that is much more than just speed; it’s a strategic tool that directly impacts customer satisfaction, brand perception, and unlocks unique, time-sensitive revenue streams.

The simple act of meeting an immediate customer need instantly positions your brand as reliable, modern, and highly convenient. QC allows you to capture those valuable, sudden consumption moments, a late-night beauty fix, a sudden craving, or an unexpected party need, that were previously only addressed by a quick trip to the local corner store.

- Capture Impulse Purchases: QC is the ideal channel for unplanned, spur-of-the-moment buying. D2C products like premium snacks, specialty coffee pods, quick beauty fixes, and personal care items with an urgent use-case see a dramatic surge in conversion when delivery is measured in minutes.

- Massive Brand Visibility: By being listed on these QC apps, which are daily utilities for millions, your D2C brand gains continuous exposure to a large, engaged user base. This serves as a powerful, high-frequency marketing channel in itself.

- Reduce Customer Acquisition Cost (CAC) for Replenishment: QC platforms are excellent channels for driving repeat purchases. Once a customer tries your D2C product via a quick order, they are highly likely to reorder through the same convenient channel, effectively lowering your cost to acquire that crucial repeat transaction.

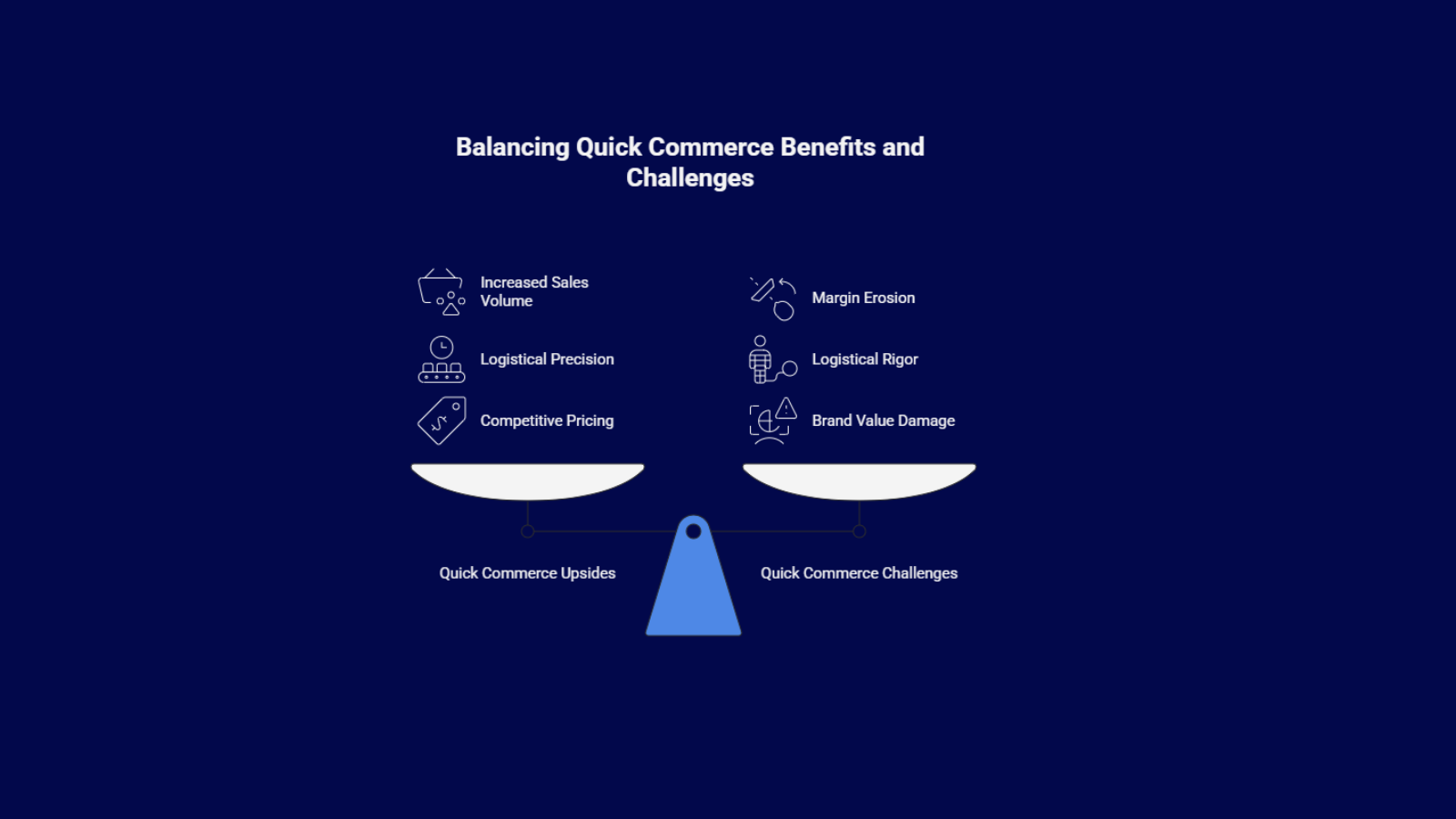

What operational and financial challenges does Quick Commerce pose for D2C Brands?

While the upside of QC is huge, D2C brands must enter this space with a clear understanding of the operational intensity and financial pressures that come with the ultra-fast delivery model. If these challenges are not managed rigorously, they can quickly erase the profitability gains from increased sales volume.

The high demands of Q-Commerce require an unprecedented level of logistical precision and speed, which can be both challenging to execute and potentially costly for smaller D2C brands if operations aren’t absolutely flawless.

- Margin Erosion due to High Commissions: The biggest hurdle is cost. QC platforms charge high commissions (often higher than standard marketplaces) to cover the elevated operational costs of running a decentralized dark store network and managing instant logistics, which directly squeezes the D2C brand’s already tight profit margin.

- Logistical Rigor and Penalties: QC demands perfection from the supply chain. Brands must maintain hyper-accurate, real-time stock levels in the dark stores. Any stock-outs or delays in replenishment can lead to heavy financial penalties or temporary product suspension, severely disrupting sales.

- Pricing Pressure and Brand Value: The competitive, high-volume nature of QC often forces D2C brands to offer frequent discounts or aggressive pricing, which can sometimes damage the premium brand value you’ve worked hard to establish on your own D2C website.

Ready to Scale Your D2C Brand in India’s Quick Commerce Era?

Succeeding in Indian Quick Commerce requires more than just listing; it demands mastering the art of real-time inventory synchronization, navigating complex margin structures, and strategically managing multiple high-speed dark store networks. This is the surest way to achieve profitable, high-velocity growth.

Take the next critical step in optimizing your Quick Commerce and D2C strategy by ensuring your digital foundation is robust and future-proof.

Visit Base.com today to explore comprehensive, enterprise-grade e-commerce solutions that empower Indian D2C sellers with the tools needed to flawlessly manage a multi-channel strategy, guaranteeing your owned platform remains the highly profitable core while leveraging Quick Commerce for unparalleled volume and market reach.

Click here to integrate Zoho with Base.com.

Frequently Asked Questions (FAQ) for D2C Sellers

1. How does Quick Commerce differ from traditional e-commerce for a D2C brand?

Traditional e-commerce serves planned purchases through centralized warehouses with multi day delivery. Quick Commerce targets impulse and urgent needs with 10 to 30 minute delivery from hyperlocal dark stores. For D2C brands, traditional channels build loyalty and high AOV, while QC drives frequency and penetration for everyday or urgent items.

2. Is the Quick Commerce model sustainable for platforms and D2C brands?

It can be, but only with the right SKU strategy. Platforms are improving sustainability through better tech and higher order values. For D2C brands, QC works only when used for high volume, low ticket, repeat products. Selling core high margin items at a loss on QC is not sustainable.

3. Should D2C brands prioritize Quick Commerce over their own website?

No. The D2C site is the brand’s most valuable asset because it owns the customer, the data, and the experience. QC should be a secondary distribution channel to capture immediate consumption moments, not the center of brand strategy.