Quick Commerce, or Q-Commerce, isn’t just an upgrade to online shopping; it’s a complete rewrite of the consumer’s rulebook in India’s metro cities for 2025. This model, promising delivery of essentials and groceries in minutes, is forcing every single brand and retailer to rethink their strategy, their logistics, and even their product mix. As the Indian grocery market surges toward a massive INR 78 lakh crore valuation by the end of the decade, Q-Commerce platforms are the central players driving that growth by making “right now” the only time that matters.

Why Ultra-Fast Delivery Has Become Urban India’s Preferred Shopping Habit

For the city consumer, time is the rarest commodity. Q-Commerce solved the problem of the missing ingredient or the sudden need for a snack by collapsing the delivery time window. This shift is profound: consumers are moving away from planning multi-day deliveries (like traditional e-commerce) or enduring neighborhood traffic (like physical stores) and moving toward instant fulfillment. This convenience is the sticky factor that locks people onto these apps.

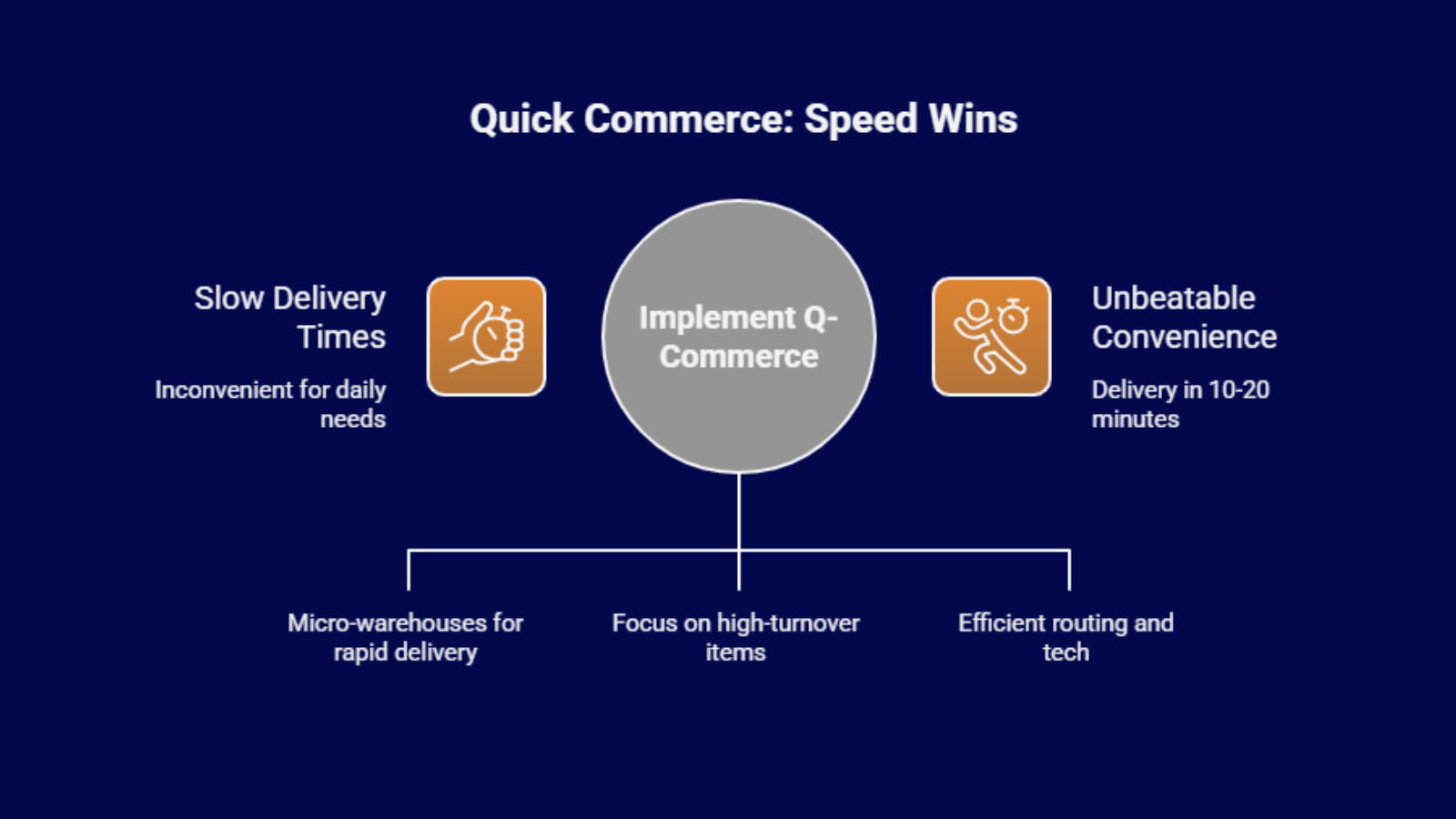

The Q-Commerce model is built on an entirely unique logistical infrastructure,the dark store. These micro-warehouses, tucked deep inside residential pockets, are optimized for speed, not browsing, giving them a distinct competitive edge:

The Operational Edge of Quick Commerce

- Unbeatable Convenience: Delivery times in the 10-to-20 minute range make these services a true utility for daily needs.

- Curated Inventory: The focus is on high-turnover items,the 2,000 products everyone buys frequently,ensuring rapid picking and low out-of-stock rates.

- Lean Logistics: Advanced tech and smart routing manage the movement of delivery partners efficiently, keeping costs down and reducing wasted time.

This powerful proposition is why the Q-Commerce market is set to triple in size between 2024 and 2027, eventually reaching a value of up to INR 1.7 lakh crore. The consumer has spoken: speed wins.

How Q-Commerce Is Creating Fresh Consumption Instead of Just Shifting It

One of the most important takeaways for the business community is that Q-Commerce doesn’t just shuffle sales between stores. Yes, it takes business from traditional e-commerce and modern supermarkets, but its true economic impact lies in creating new demand.

Because the delivery is so fast and frictionless, households are buying items they would have previously postponed or simply forgotten. This impulsive, instant purchasing adds an estimated 6 to 8 percent of genuinely new sales volume to the total market.

How Consumer Behavior is Changing Product Sales?

- Impulse Categories are Booming: Sales of items like chips, cold beverages, confectionery, and ice cream have surged, becoming frequent, on-demand buys.

- Gifting Gets Faster: The need for last-minute celebratory items or urgent gifts is perfectly serviced, making Q-Commerce a reliable go-to for special occasions.

- Premium Brands are Launching Here: High-end brands in personal care, gourmet food, and gifting are prioritizing Q-Commerce for new product launches. This confirms the platform’s role as a driver of premiumization because instant access encourages consumers to easily trade up.

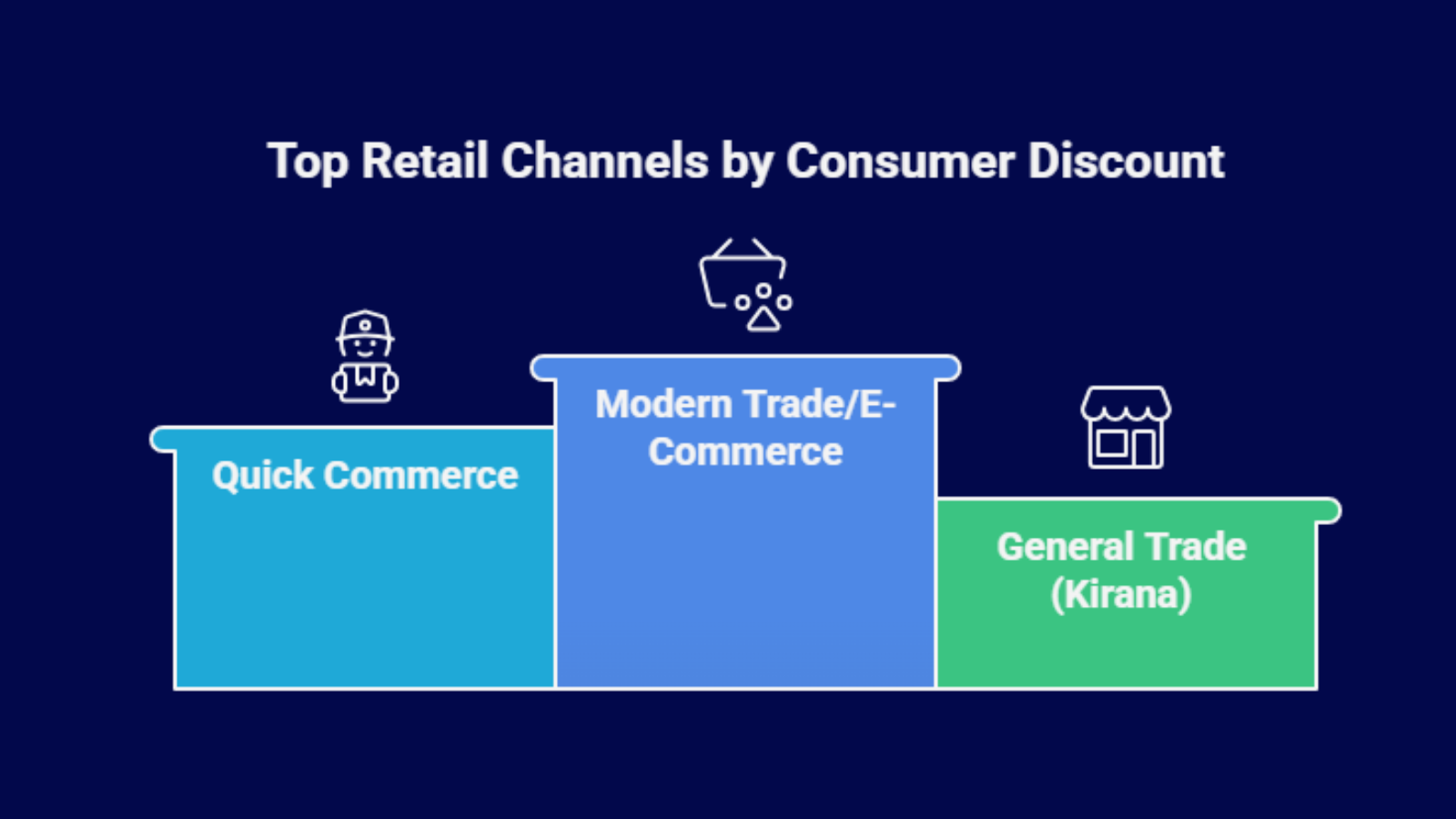

| Retail Channel | Typical Consumer Discount | Primary Reason People Shop There |

|---|---|---|

| Modern Trade/E-Commerce | 13% to 18% | Deepest Discounts, Widest Selection |

| Quick Commerce | 6% to 9% | Speed, Convenience, Immediate Access |

| General Trade (Kirana) | 2% to 5% | Trust, Local Proximity, Credit Facility |

The data is clear: Q-Commerce isn’t built on price wars. The convenience factor is the real differentiator, often outweighing the bigger discounts offered by other channels.

How Q-Commerce Is Becoming One of India’s Largest Job Creators?

The rapid expansion of quick commerce is creating a huge employment opportunity, particularly for the blue-collar workforce. Its hyper-local model demands a large network of people for fulfillment and last-mile delivery. In fact, Q-Commerce is nearly on par with the traditionally high job-generating Kirana stores in terms of employment density per unit of sales.

This employment pattern is fundamentally different from a large, centralized warehouse model.

Employment Density by Sales Volume (Per INR Crore of Monthly GMV)

| Retail Channel | Total Jobs Created | Last-Mile Logistics Jobs |

|---|---|---|

| General Trade | 63 to 66 | Very Few |

| Quick Commerce | 62 to 64 | More than 46 |

| Modern Trade | 41 to 42 | Very Few |

| E-Commerce | 25 to 29 | 13 to 15 |

The vast majority of these Q-Commerce jobs are in last-mile logistics, which is the most labor-intensive part of the operation. This reliance is expected to drive a 60% surge in gig worker hiring in 2025. The platform model offers flexible hours, allowing people to earn supplementary income across urban and semi-urban areas, making it a critical, distributed source of income. This structural shift is also driving new government policies to improve social security and benefits for this large, flexible workforce.

Why Brands Are Increasing Spend on Q-Commerce in 2025

Brand investment strategies used to be simple: prioritize e-commerce and modern trade. That landscape is now changing rapidly. As consumers increase their spending and frequency on Q-Commerce, brands,especially those in the FMCG sector,are compelled to reallocate their marketing and trade promotion budgets.

If your product isn’t visible on the quick commerce app, you’re losing the impulse sale battle.

Where Brand Money is Moving

- For food categories, investments in quick commerce now match those in traditional e-commerce. Because food has high repeat purchase rates and is often bought spontaneously, brands recognize this channel as vital for real-time customer acquisition and loyalty.

- For non-food categories (personal care, household goods), investments are increasing steadily. The convenience of getting an essential item immediately is pulling these segments onto the quick platform, forcing brands to adjust their focus.

In short, Q-Commerce is no longer a sideline; it’s a primary sales channel that demands significant budget and tailored strategy from every major brand looking to capture the modern urban consumer.

Why Q-Commerce Will Continue to Dominate?

Quick commerce has cemented its place as a core pillar of modern Indian retail. It succeeded by prioritizing speed above all else, thereby altering consumer expectations, boosting overall consumption, and becoming a major employer. While it will continue to coexist with Kirana stores (which offer trust and credit) and modern trade (which offers the deepest discounts), it represents the future of high-frequency shopping.

To compete in this new environment, businesses must master the art of hyperlocal logistics and real-time inventory management.

Is your business built for the speed of the new Indian consumer?

Get in touch to discover how Base.com can optimize your operational flow and help you integrate a winning quick commerce strategy today.

Frequently Asked Questions About Q-Commerce in India (2025)

1. Is Q-Commerce replacing traditional Kirana stores?

Not entirely. Q-Commerce takes some business from kiranas but also expands total consumption. Kiranas still win on trust, freshness, and credit.

2. Why are consumers willing to pay more on Q-Commerce?

Speed and convenience outweigh discounts. Instant delivery solves immediate needs that other channels cannot match.

3. Which categories grow fastest on Q-Commerce?

Snacks, beverages, ice cream, gifting, gourmet foods, and premium personal care are the biggest gainers.

4. Are Q-Commerce jobs sustainable or temporary?

Most roles are gig-based, but demand keeps rising. Last-mile delivery continues to be a strong source of flexible urban and semi-urban employment.

5. Will Q-Commerce spread beyond metro cities?

Yes. Q-Commerce is expanding into cities with populations above 500,000 and will soon reach deeper urban clusters.