The days of treating e-commerce fulfillment as a two-day promise are officially over. If you’re a brand selling consumer goods today, your competition isn’t just your rival’s product; it’s their delivery speed. This is the core principle driving the rapid proliferation of dark stores, the dedicated, customer-free fulfillment centers that are reshaping the urban retail landscape.

Dark stores aren’t just small warehouses; they are sophisticated, strategically placed micro-fulfillment centers optimized entirely for online order processing. They represent the ultimate adaptive move by retailers, converting underperforming or even traditional retail spaces into hyper-efficient dispatch hubs. Global events accelerated this shift, but constantly rising customer expectations drive it. Brands must understand that dark stores are the new logistics backbone for any quick commerce or rapid delivery strategy, offering a competitive edge that traditional warehousing simply cannot match.

Why Must Brands Adopt the Hyperlocal Fulfillment Model Now?

This isn’t a temporary trend; it’s a fundamental change in how goods move from seller to consumer. Traditional warehouses are miles away, designed for bulk storage. Brands build dark stores for immediacy, placing inventory seconds away from their highest-value customers. If you ignore this shift, you hand your high-frequency, high-impulse sales to competitors who are already embedded in urban neighborhoods.

The advantages of this model are not just theoretical; they translate directly into tangible gains in revenue and customer loyalty.

Key Advantages of Dark Stores for Brands

- Unrivaled Speed and Last-Mile Cost Reduction: By placing inventory within a compact delivery radius (often less than two miles from 80% of customers), dark stores enable delivery times under 30 minutes. This drastically cuts the expensive “last-mile” distance, often reducing the cost per delivery from the $8–$12 range down to $3–$5.

- Enhanced Efficiency and Inventory Control: Unlike retail stores, dark stores are laid out for pure picking efficiency, no decorative aisles or slow-moving customers. This optimized layout, coupled with real-time inventory management systems, dramatically lowers mispack rates (often below 0.5%) and reduces stockouts of locally popular items.

- Superior Customer Satisfaction and Loyalty: Faster deliveries aren’t just convenient; they drive higher conversion rates (up to 23% higher for sub-2-hour delivery options) and build robust customer lifetime value. They turn a purchase into a reliable, instant solution.

- Scalability for Peak Demand: Brands can build a decentralized network of dark stores to handle massive demand surges, such as during holiday seasons, by simply activating capacity in existing, nearby locations rather than relying on a single, congested central warehouse.

Brands that focus on speed and accuracy, the twin pillars of the dark store model, will inevitably capture market share from slower, more centralized competitors.

What are the Strategic Costs and Headaches Brands Must Prepare For?

While the benefits are clear, entering the dark store arena is not cheap or simple. It requires a significant upfront capital commitment and a completely different approach to operations. This is an investment in infrastructure and technology, not just rent.

You must be prepared for the high fixed costs and the complex logistics of managing a dispersed, fast-moving network.

Key Challenges and Investment Areas

- Prohibitive Urban Real Estate Costs: This is the single biggest fixed cost. You need small facilities in densely populated, high-rent areas. While a dark store requires less space than a traditional warehouse, the cost per square foot is 3x to 4x higher than traditional industrial space.

- Sellers need to analyze specific urban rental markets, where a suitable 2,000–3,000 sq. ft. space in a Tier 1 metro could easily demand high rental advances and monthly costs.

- Significant Technology Investment: To achieve true efficiency, basic shelving isn’t enough. Investment is mandatory for:

- AI-Powered Demand Forecasting: Essential for minimizing stockouts and overstocking specific to a single neighborhood.

- Real-Time Inventory and WMS: Systems that track every product location in real-time, integrated with order management software.

- Automation (Micro-Fulfillment Centers): For the highest volume locations, systems like Goods-to-Person (G2P) robotics can cost $1 million to $3 million initially, but reduce picking time by up to 65%.

- The technology backbone is what allows dark stores to run efficiently, achieving payback timelines of 12–24 months at scale.

- Logistics and Rider Management Complexity: Managing a dense network of riders for 15-minute fulfillment requires advanced route optimization software and a dedicated logistics team. The system must process an order and dispatch a rider seamlessly, every time.

- Maintaining service quality and handling the operational volatility of gig economy labor across multiple urban hubs requires robust platform technology and continuous monitoring.

- Pressure on Forecasting Accuracy: In a high-turnover environment, miscalculating local demand for a specific SKU in a specific neighborhood can lead to costly stockouts or spoilage. Predictive analytics must be hyper-local and accurate.

- Brands cannot afford to treat all dark stores the same; inventory must be highly tailored to the micro-demographics of each store’s catchment area.

What Must Brands Do Now to Win the Quick Commerce Race?

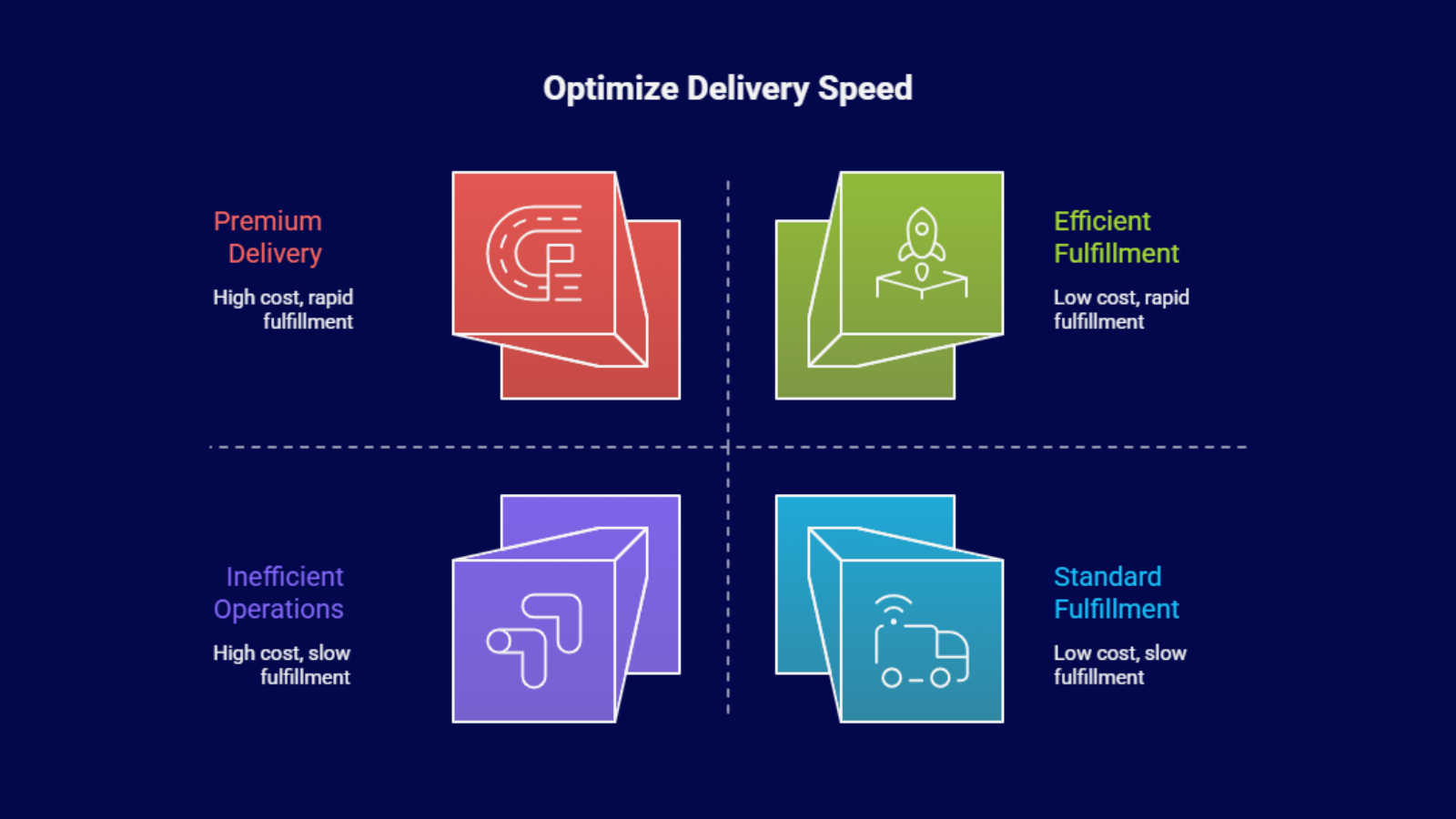

The decision is simple: either embrace the complexity and cost of a modern fulfillment strategy, or resign yourself to competing solely on price in the traditional two-day delivery window. For brands that choose to compete on speed, the strategy must be comprehensive and data-driven.

The goal is to move from a reactive shipping model to a proactive fulfillment ecosystem.

Actionable Directives for Brands

- Embrace the Hyperlocal Model as a Primary Channel: Recognize that dark stores are the non-negotiable infrastructure of quick commerce. Your investment must reflect this reality, shifting capital allocation away from general warehousing toward these urban centers.

- A seller’s inventory and logistics planning must be decentralized, treating each dark store as a unique, data-driven entity.

- Invest Strategically in Technology and Automation: Start by adopting best-in-class AI and smart forecasting tools to optimize inventory. For high-volume locations, plan phased investment in automation (robotics) to boost picking efficiency from 15–25 orders/hour (manual) to 60–80 orders/hour (optimized dark store).

- The technology is the multiplier, allowing a small physical space to handle the order volume of a much larger traditional facility.

- Optimize Inventory Based on Micro-Demographics: Use data, not guesswork, to stock each store. If one dark store serves an area with a high percentage of nuclear families, stock more bulk goods. If another serves a student dormitory area, prioritize impulse snacks and single-serve items. This targeted stocking is critical for maximizing sales volume and minimizing capital tied up in slow-moving inventory.

- This hyper-localization boosts the order fill rate, directly improving the customer experience and reducing fulfillment failures.

- Monitor Mission-Critical KPIs Obsessively: The success of the network is measured in seconds and accuracy. Brands must closely track metrics that affect speed and efficiency:

- Order-to-Delivery Time: Total time elapsed from click to door.

- Picking Accuracy Rate: The percentage of orders packed correctly.

- Last-Mile Cost per Order: The true cost of getting the item to the customer.

- Inventory Turnover Rate: How quickly inventory is moving through each specific dark store.

- These metrics provide the real-time data needed to identify and fix bottlenecks that can destroy unit economics.

Ready to Redefine Your Retail Fulfillment Strategy?

The window of opportunity to gain a first-mover advantage with hyperlocal fulfillment is closing fast. Every major competitor is already making massive capital investments in dark stores because they know it’s the only way to meet modern customer expectations. Your ability to scale and sustain a competitive edge hinges on implementing a sophisticated, technology-driven logistics platform.

Need the right technology to manage a complex, decentralized dark store network?

Contact Base.com to discover how our integrated fulfillment platform can optimize your inventory, streamline your last-mile logistics, and ensure your brand leads the quick commerce race.

Frequently Asked Questions (FAQ)

Q1: How do dark stores differ from traditional warehouses or micro-fulfillment centers (MFCs)?

A: Traditional warehouses are large, located far from cities, and designed for long-term storage and bulk distribution. Dark stores are smaller, urban, and optimized solely for rapid direct-to-consumer (D2C) order picking and local delivery. MFCs, while similar in size, often refer to highly automated facilities, while a dark store can be manual or automated.

Q2: Is converting an existing retail store into a dark store a viable option?

A: Absolutely. Converting an underperforming brick-and-mortar location into a dark store is a highly viable strategy, popularized by companies like Amazon and being adapted by others. This method leverages existing real estate and allows retailers to adapt to shifting consumer demand by focusing the space entirely on efficient fulfillment rather than customer browsing.

Q3: Is the dark store model only suitable for grocery or FMCG products?

A: No. While grocery was the pioneer, the model is spreading. It’s effective for any product with a high impulse factor or a need for immediate fulfillment, including personal care products, small electronics, apparel (for click-and-collect), and pharmaceuticals. Any brand competing on speed can benefit.