Let’s be honest: five years ago, getting your groceries the next day felt like a win. Today? If it takes more than 15 minutes, your customers are already checking a competitor. That’s the brutal reality of Quick Commerce (aka 10-Minute Delivery Model) in India. It’s not just a faster way to deliver; it’s a complete rewiring of the urban consumer’s brain. For any brand or seller focused on retail, this shift in expectation is the single most important trend right now. Ignore it at your peril.

The entire Indian hyperlocal market is surging past 50% annual growth. This isn’t just a big number; it’s proof that demand has snapped. The customer has tasted instant service, and there is absolutely no going back.

What Exactly is the New Standard for Convenience in Urban Retail?

The consumer mindset has fundamentally changed. We used to budget time for shopping, traveling to the mall, browsing online lists, enduring the two-day shipping window. 10-Minute Delivery platforms like Zepto, Blinkit, and Swiggy Instamart have completely eliminated that mental cost. They’ve turned waiting into an unacceptable inconvenience.

This means time isn’t just saved; it’s been monetized. Customers now view the time a delivery takes as a tangible resource. If your service takes 30 minutes when a competitor offers 10, the customer feels genuinely short-changed. It’s a psychological tension that demands an immediate, frictionless answer.

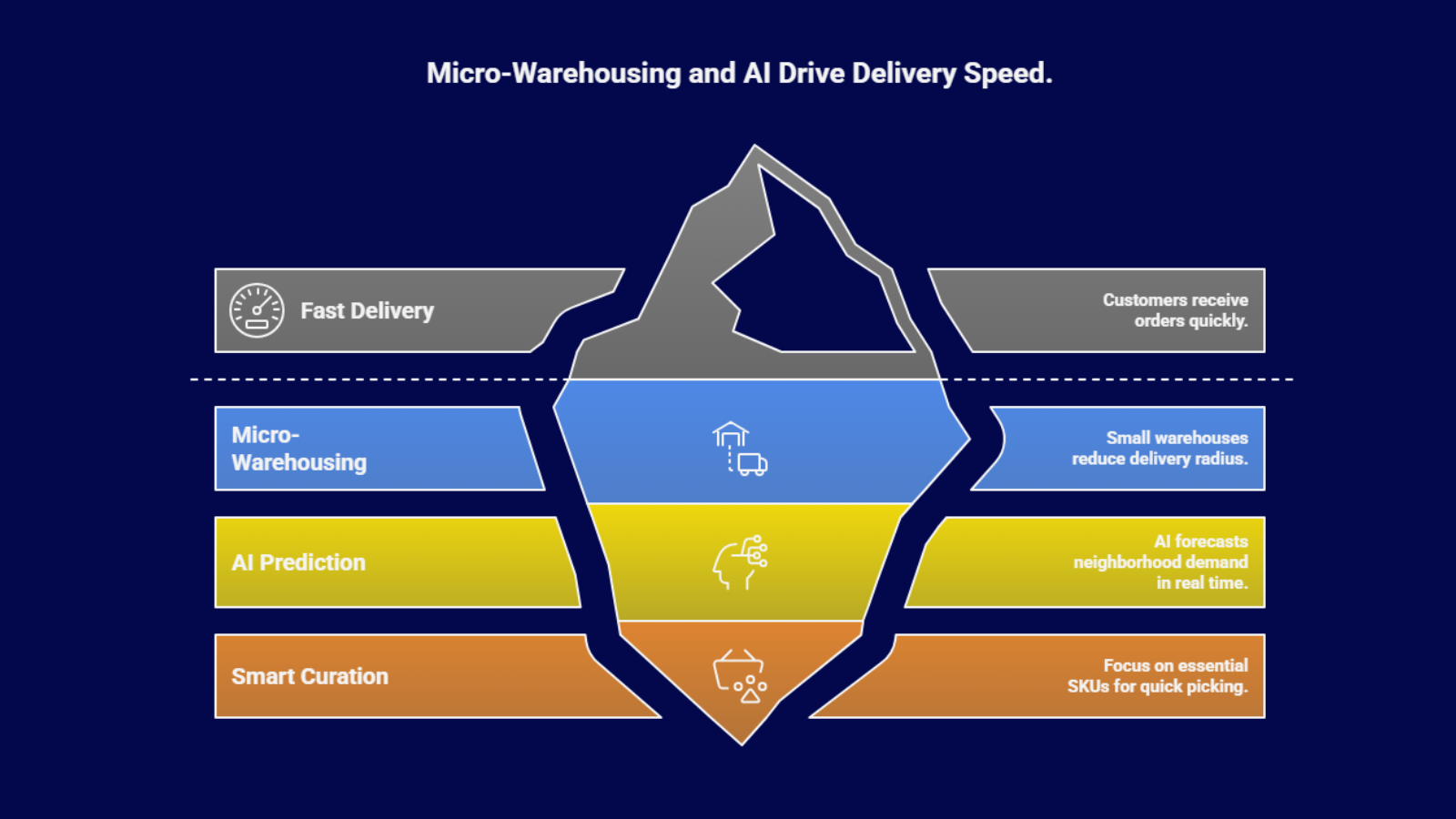

So, how do they pull off this magic trick? It’s pure operational gymnastics and smart real estate:

The Real Engine Behind the Speed

- Micro-Warehousing, Metro-Deep: We’re talking about dark stores, small, specialized warehouses (often just 600–1,200 sq. ft.) buried deep inside residential areas. The goal? Shrink the delivery radius down to almost nothing. No travel time for the customer, minimal travel time for the rider.

- AI Doing the Heavy Lifting: This isn’t a human managing inventory. AI systems are predicting, in real time, exactly how many packets of biscuits or cartons of milk a neighborhood will buy in the next three hours. This predictive analytics ensures high-velocity items are always stocked and ready to go.

- Smart Product Curation: They don’t try to stock everything. They focus on 1,200 to 2,000 SKUs, the essentials, the impulse buys, allowing the picker to grab and dispatch an order in under 60 seconds. Speed over selection, every time.

How Does 10-Minute Delivery Change Our Buying Habits?

The biggest myth about 10-Minute Delivery was that it would just cannibalize sales from the local kirana. The truth is more interesting: it’s creating entirely new sales.

When buying is this easy, the line between planning and impulse vanishes. Buyers are no longer waiting for the weekly grocery list to realize they need toothpaste; they order it the second the tube runs out. They’re not saving ice cream for a weekend treat; they’re ordering it at 10 PM on a Tuesday. This shift is adding a solid 6 to 8 percent of genuine, new sales volume to the market that wouldn’t have existed otherwise.

It affects every part of the seller’s strategy:

The New Rules of the Customer Journey

- Frequency Trumps Basket Size: Customers make multiple small, high-frequency purchases instead of one massive weekly run. This changes how you package, promote, and position your products.

- Impulse is the Primary Driver: Snacks, sodas, and convenience foods are the star performers. They’ve moved from being planned purchases to immediate need fulfillment. This is where your marketing budget should follow.

- Loyalty is Earned Every 10 Minutes: Consistency is everything. A positive, sub-15-minute experience builds loyalty faster than any discount code. Mess up the delivery, and you’ve lost the customer for good.

| Retail Channel | Core Discount Strategy | What the Customer Really Pays For |

| Traditional E-Comm | Deepest Bulk Discounts (13%+) | Selection, Low Price, Scheduled Delivery |

| Quick Commerce aka 10-Minute Delivery Model | Moderate Discounts (6–9%) | Zero Waiting Time, Immediate Need Fulfillment |

| Kirana Store | Minimal Discounts (2–5%) | Credit Facility, Personal Trust, Local Proximity |

Notice this: 10-Minute Delivery isn’t winning on price. It’s winning on convenience. Sellers who understand that the customer is paying a premium for speed, not a discount on goods, will master this channel.

Can This Hyper-Speed Model Actually Be Profitable?

That’s the million-dollar question keeping platform CEOs awake. The dark store model is expensive. You are renting small spaces in prime city locations, paying rents of INR 40–80 per square foot a month. Factor in the cost of employing a large, flexible gig workforce, over 46 people in last-mile logistics per unit of sales, and the unit economics look tough.

This is why many aggressive expansion pushes, like Swiggy’s, initially lead to reported net losses despite massive revenue growth. The key for sellers and partners is to understand the platform’s path to profitability, which hinges on two factors:

Where the Platforms Are Focusing Their Strategy

- Achieving Density: They must squeeze 300 to 800 orders daily out of each dark store to cover the fixed costs. This is why their focus remains locked on Tier 1 metros where population density and spending power are highest.

- The Hybrid Solution: They know dark stores can’t cover every single small town. The smarter move is the hybrid model: maintaining dark store efficiency in metros while digitally empowering local kiranas elsewhere. Programs like JioMart’s, which onboard thousands of local stores for last-mile fulfillment, are the bridge to lower-cost, wider-reach service in Tier II/III cities. This is a massive opportunity for sellers to leverage existing neighborhood networks digitally.

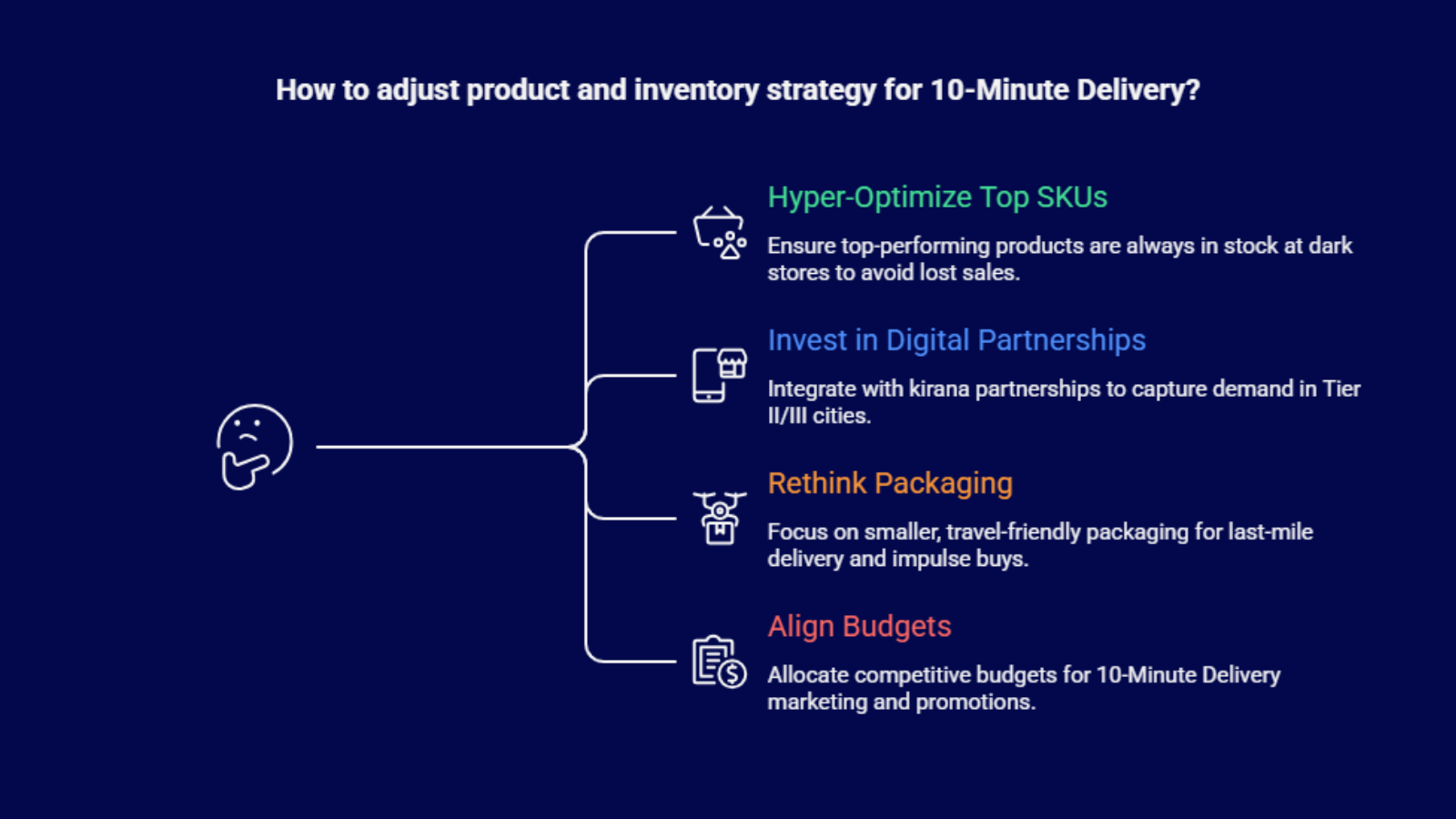

How Should Sellers Adjust Their Product and Inventory Strategy?

If you are a brand, you must stop treating 10-Minute Delivery as an afterthought. It’s now a primary sales channel that demands its own tailored strategy.

This isn’t just about listing your products; it’s about a fundamental inventory overhaul:

Direct Actions for Brands and Sellers

- Hyper-Optimize Your Top SKUs: Identify the 1,500 products that generate 80% of your 10-Minute Delivery revenue. These are the items that must be in those dark stores at all times, with zero tolerance for stock-outs. If you can’t manage this inventory in real-time, you will lose the sale.

- Invest in Digital Partnerships: If you sell in Tier II/III cities, your focus should be on integrating with the digital tools used by kirana partnerships. Your inventory needs to sync seamlessly with their newly digitized storefronts to capture sub-hour delivery demand outside the metro bubble.

- Rethink Packaging and Size: The small, frequent purchase pattern means bulk packs are less relevant. Focus on smaller, travel-friendly packaging suitable for the last-mile rider and the impulse buyer.

- Budget Alignment: Your marketing and trade promotion budgets for 10-Minute Delivery must now be competitive with (or even surpass) what you allocate to traditional e-commerce for high-frequency categories like food and personal care. You have to pay to play in this high-speed lane.

The Next Step in Retail: Move at the Speed of Demand

The age of waiting is over. Every seller, every brand, and every retailer must accept that the customer now expects immediate, frictionless fulfillment. Your ability to compete is directly tied to your operational speed and your seamless inventory integration.

Is your supply chain and digital storefront truly prepared for the 10-minute consumer?

Reach out to Base.com today. Let us show you how to integrate your operations, master hyperlocal inventory management, and ensure you capture every impulse purchase in this new, hyper-speed market.

Frequently Asked Questions (FAQ)

Q1: Is the 10-minute promise a realistic model for long-term profit?

A: The 10-minute promise is primarily a marketing tool to set the highest possible customer expectation. The real goal is consistent 15–20 minute delivery, which is where operational sustainability lies. Profitability depends entirely on achieving the necessary order density (300+ orders per dark store per day) to cover high metropolitan real estate and logistics costs.

Q2: Will smaller brands ever be able to afford the 10-Minute Delivery channel?

A: Yes, but they must be strategic. Instead of competing on the platform’s logistics, smaller brands should focus on the hybrid model. Partnering with digital solutions that integrate with existing Kirana networks (which are lower cost and higher trust) is the smarter, more capital-efficient way to achieve hyperlocal reach without building your own dark store network.

Q3: Is the 10-Minute Delivery market saturated, or is there still room for growth?

A: The market is intensely competitive in Tier 1 cities, but it is far from saturated. The next phase of growth is focused on geographic expansion into Tier II and Tier III cities, which is driving the shift toward hybrid fulfillment models and the expansion of the dark store networks by market leaders.