VIES (VAT Information Exchange System) is an advanced IT system enabling VAT information exchange between EU countries. Its main purpose is to simplify intra-EU transactions and ensure businesses apply correct VAT rates and comply with tax regulations.

One of VIES’s key functions is VAT number verification. It allows checking if a VAT number is valid in other EU countries, which is crucial for companies conducting business with other EU enterprises. Through VIES, both businesses and tax authorities can manage VAT obligations more efficiently and increase transaction transparency within the community.

VIES in Base

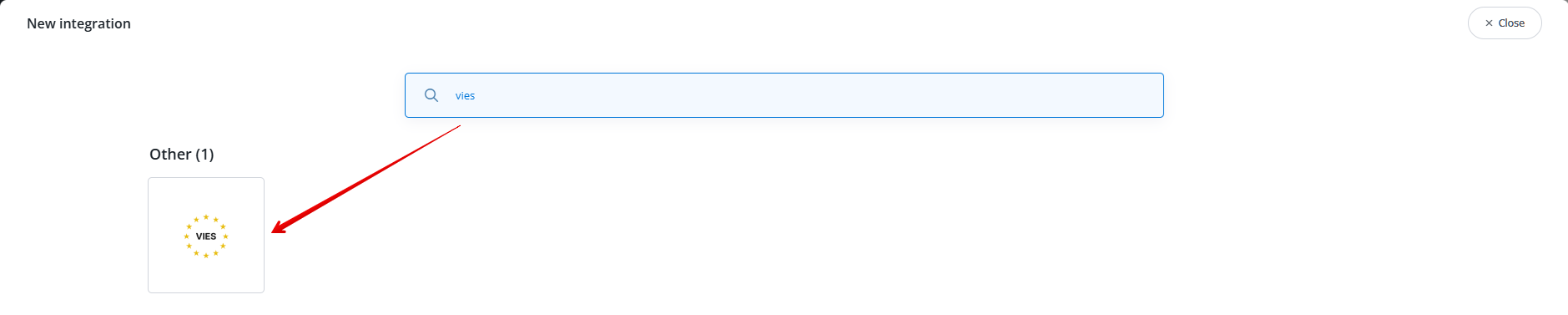

We recommend that users verifying data in VIES add and configure the VIES integration available in the Integrations section.

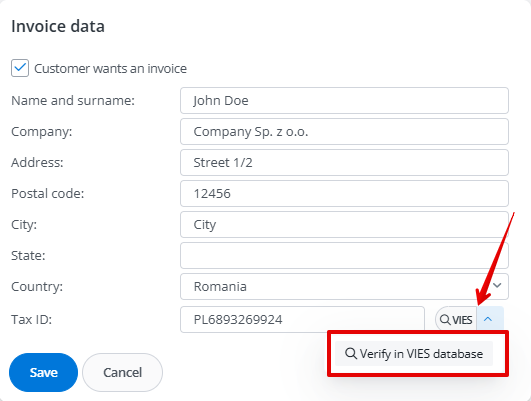

The requester’s data provided during integration setup (country and VAT number) are used to verify EU VAT numbers in the VIES database.

When connecting the integration, you can select which additional order field should store the verification result.

Status verification is free and available for all EU countries. Each query is sent to the VIES server, and upon positive verification, the UUID is saved for use on printouts. Available tags:

[tax_validation_id]

[tax_validation_source]

[tax_validation_date]

After adding VIES integration and conducting verification, the system correctly retrieves validation and UUID, adding this information to the printout (VIES confirmation).

VIES verification timing

There are two ways to conduct VIES database verification through Base: