If you’re watching the quick commerce space, and as a seller, you definitely should be, you’ve witnessed a dizzying sprint. We’re talking delivery in minutes, not days. It’s fantastic for consumers, but on the business side, it raises a huge, nagging question: Can this high-speed, high-cost model actually make money? Is it more than just an investor-funded fantasy?

The good news is, the industry is getting real. We’re moving past the “grow at any cost” mindset and focusing hard on sustainability. The answer is yes, quick commerce can be profitable, but only if the players stop bleeding cash and start meticulously pulling the right levers. This isn’t a matter of luck; it’s about mastering unit economics, which is something every seller must understand if they want to partner successfully in this space. It’s the new playbook for profitable growth.

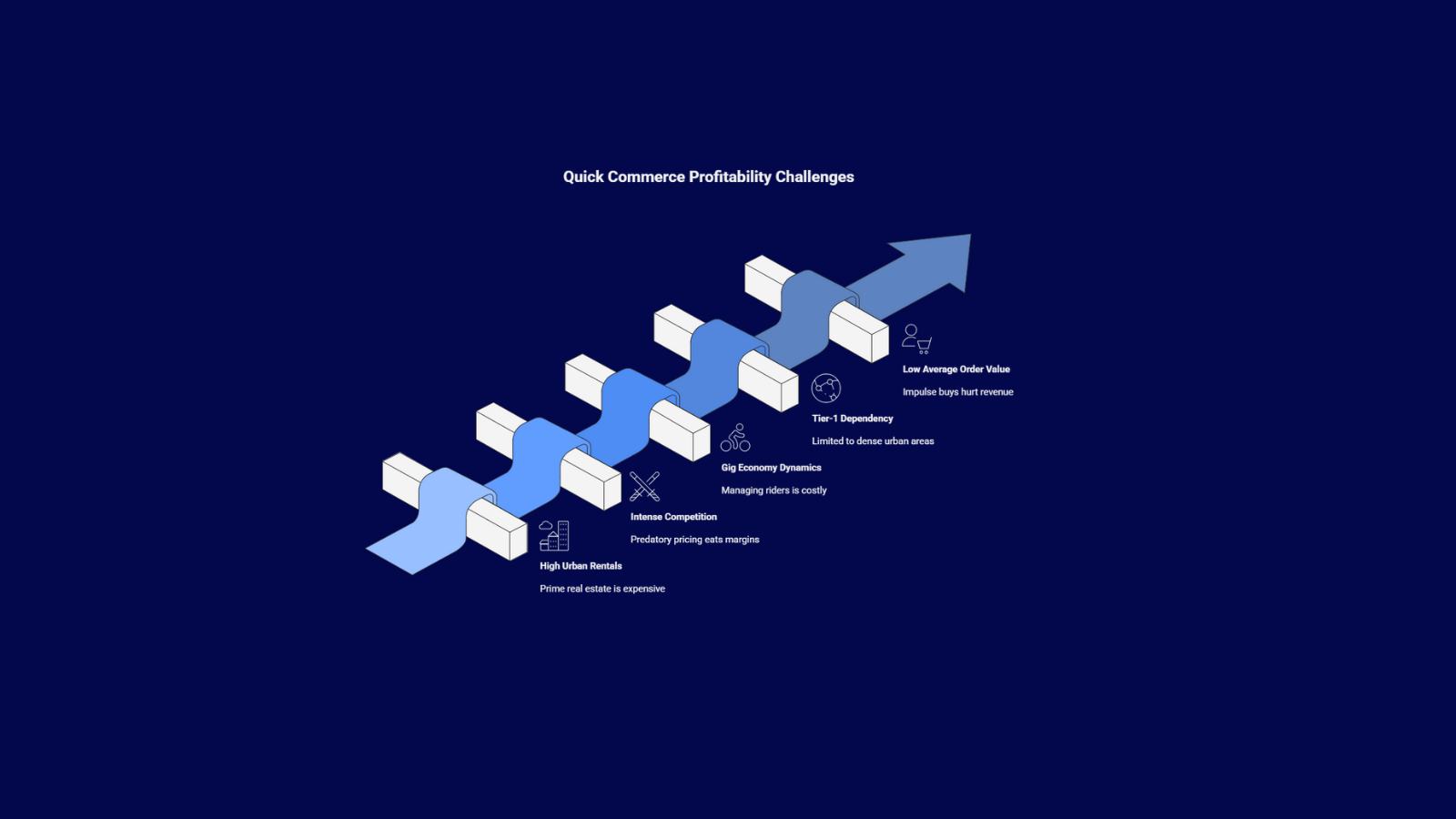

Why Is the Profitability Equation So Brutal in Quick Commerce?

Before we look at the fixes, let’s talk about challenges. Why is it so difficult to turn a profit when the business is booming? Well, the quick commerce model is inherently expensive. Think about it: you’re dealing with enormous fixed costs and relentless capital expenditure (CAPEX) just to set up and maintain the dark stores, technology, and delivery fleet. It’s a heavy lift before the first order even goes out.

Then you factor in the current market dynamics. That massive surge in demand we saw during the pandemic? It’s leveled off. Growth rates are normalizing. At the same time, consumers are tightening their budgets, making them highly price sensitive. We can’t just hike prices to cover our costs anymore.

On top of that, competition is still cutthroat; no one has a monopoly yet. And let’s not forget inflation, which is hitting everything from labor costs to rent. Finally, the VC money tap is tightening up. All these factors combined mean that increasing cash runway and prioritizing profit over sheer scale is no longer optional; it’s survival.

1. High Urban Rentals (The Dark Store Drain)

This is a classic case of fixed costs killing unit economics. Quick commerce is built on the promise of proximity. To deliver in 10-20 minutes, players like Blinkit and Zepto can’t use warehouses on the city outskirts; they need dark stores right in the middle of high-density residential and commercial areas.

- The Prime Real Estate Tax: Setting up micro-fulfillment centers within a 2-3 km radius of the customer means paying prime urban rent, think the high street prices of Bengaluru’s Sarjapur Road or Mumbai’s Bandra, for what is essentially a small, utilitarian warehouse.

- Rental Wars: The aggressive expansion of major players (Instamart, Blinkit, Zepto) has created intense competition for these specific, ground-floor urban spaces, driving up rents by 25-40% in contested micro-markets. Landlords know they hold the power.

- Zoning and Infrastructure: These dark stores are often forced into spaces that weren’t designed for high-traffic commercial logistics, leading to issues with zoning compliance, local congestion, and straining local infrastructure. This adds hidden operational risk.

2. Intense Competition (The Subsidy Trap)

The Indian quick commerce space is a clear example of an oligopoly where three or four major players (Blinkit, Swiggy Instamart, Zepto) are locked in a high-stakes, high-cash-burn battle for market share.

- Price and Discount Wars: To win a new customer or to get them to switch from a rival, platforms rely heavily on predatory pricing and constant discounts (e.g., ₹9 delivery, first-order coupons). This instantly eats into the already thin product margin.

- Customer Loyalty is Weak: Consumers, being highly value-conscious, often platform-hop based on who is offering the best price or fastest delivery at that moment. This results in an increased Customer Acquisition Cost (CAC), as platforms have to constantly bribe customers to return.

- Kirana Store Competition: Quick commerce doesn’t just compete with each other; they compete with the 13 million-strong local kirana network. The kirana store offers proximity, trust, and even informal credit, advantages that digital players struggle to replicate.

3. Gig Economy Dynamics (The Human Cost)

The quick commerce model is entirely dependent on a massive, flexible fleet of riders (the “gig economy workforce”), and managing this human element is both expensive and ethically complex.

- High Delivery Cost: Despite the high number of riders, the cost per delivery remains high in India due to urban traffic, complex addresses, and the need for frequent, small trips. Last-mile logistics remain the largest variable expense.

- Rider Attrition and Incentives: Keeping riders motivated and reducing attrition requires significant spending on incentives, training, and base pay. Platforms are under social and regulatory pressure to improve working conditions, offer insurance, and ensure fair wages, all of which raise the cost-to-serve.

- Safety and Efficiency Trade-Off: The 10-minute promise puts immense pressure on riders, leading to safety concerns and public scrutiny. Platforms must invest in route optimization and safety compliance to manage this risk, which adds to operational overhead.

4. Tier-1 Dependency (The Scalability Wall)

Despite the national excitement, the quick commerce model is heavily concentrated and profitable (or close to profitable) only in the dense urban centers.

- Uneven Demand Density: Approximately 80-85% of the sector’s Gross Merchandise Value (GMV) comes from the top 8 to 10 metro cities. This high demand density is crucial for hitting the 300-400 orders per day needed for a dark store to break even.

- The Non-Metro Conundrum: Attempts to scale into Tier-2 and Tier-3 cities often fail because the population density and consumer digital maturity are too low. Dark stores in smaller towns may handle only 350-700 orders per day, falling well short of the profitability threshold.

- Higher Cost to Serve: In non-metro areas, the delivery radius is often larger, and logistical infrastructure (like good roads or clear addressing) is poorer. This forces platforms to incur higher delivery payouts for lower order volumes, making the unit economics much worse.

5. Low Average Order Value (AOV) Challenge

In the quick commerce model, most purchases are small, unplanned, and immediate, not planned, bulk grocery trips. This means the revenue generated by an average transaction is often too low to cover the high fulfillment and delivery costs.

- Impulse vs. Stock-Up: Quick commerce thrives on impulse purchases (“I ran out of milk and bread”) rather than the profitable “stock-up” trips typical of modern retail.

- Profitability Gap: If the cost to pick, pack, and deliver an order is ₹80, and the average gross margin on a ₹450 basket is only ₹70, the company is losing money on every order.

- The AOV Target: To cover all their fixed and variable costs, quick commerce platforms must push the AOV up to the ₹600–₹700 range. This requires aggressive cross-selling, minimum order values, and adding high-value, non-grocery items like electronics and beauty products to the catalog.

What Are the Non-Negotiable Cost Levers for Survival?

For any quick commerce player, or seller partnering with one, efficiency is the ultimate currency. Since you can’t eliminate costs entirely, you have to be ruthless about optimizing the components that scale with every order.

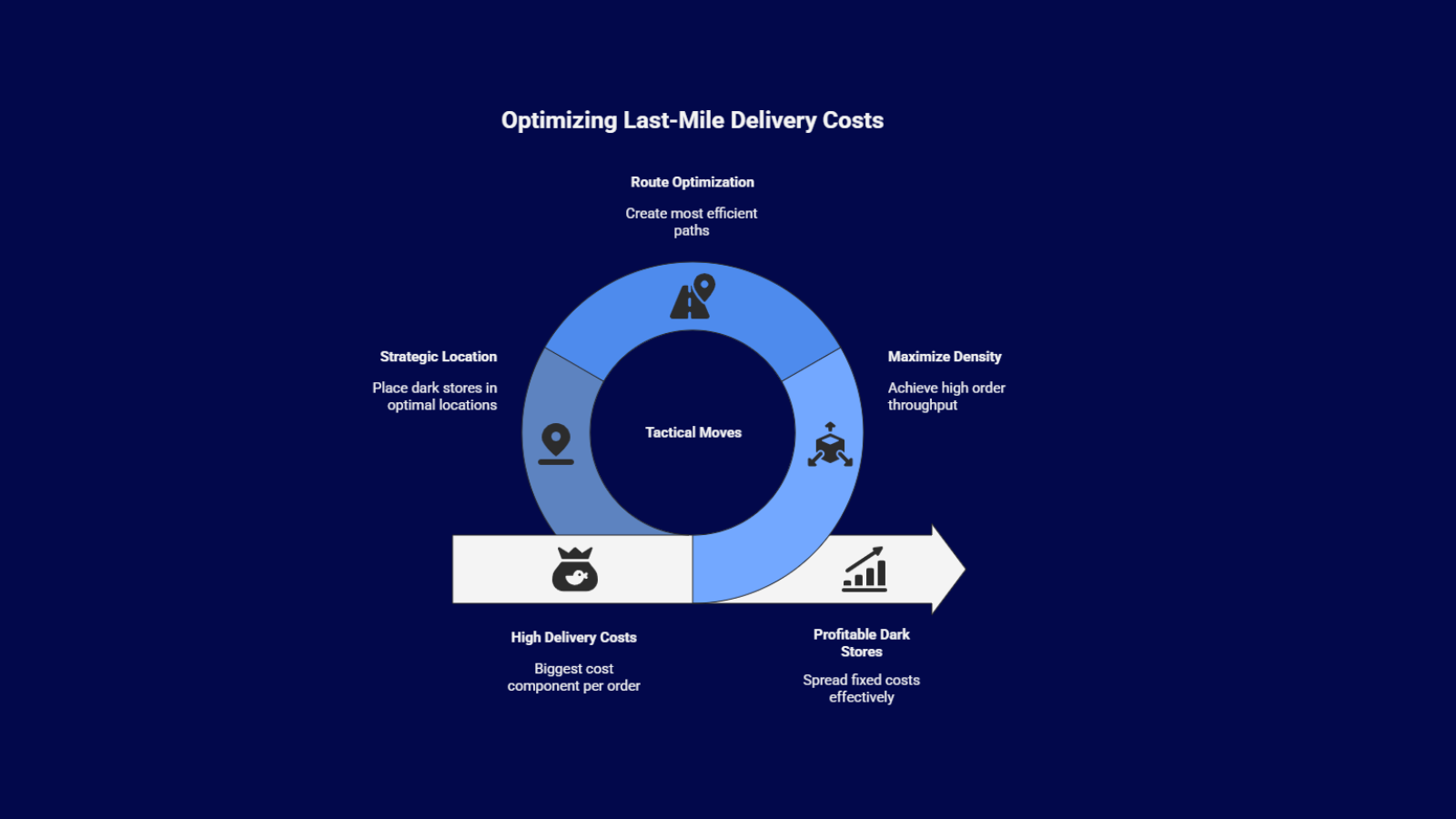

How Do We Attack the Monster: Last-Mile Delivery Costs?

The biggest hurdle, the absolute cost monster in quick commerce, is the last mile. This is the single largest cost component per order, and if we don’t fix this, we don’t make money. The solution involves three tactical moves: density, routing, and location.

To actually make a dark store profitable, we have to spread those fixed costs over a mountain of orders. That means hitting serious order throughput. The benchmark everyone talks about is achieving 300 to 400 orders per day per dark store to hit the operational breakeven point.

Key strategies for minimizing this monumental expense include:

- Maximizing Density: Operational success hinges on achieving high order throughput. We need 300–400 orders per day to efficiently spread the high fixed costs associated with the location and staffing.

- Route Optimization: This isn’t just about avoiding traffic; it means using AI and data science to create the most efficient paths possible. Sometimes, efficiency means strategically batching orders, even if it nudges delivery time from an aggressive 10 minutes to a more practical 30–45 minutes.

- Strategic Location: We must place dark stores in low-rent, urban locations that are still extremely close to high-demand areas. The sweet spot minimizes delivery distance, ideally keeping all drops under 3 kilometers from the fulfillment hub.

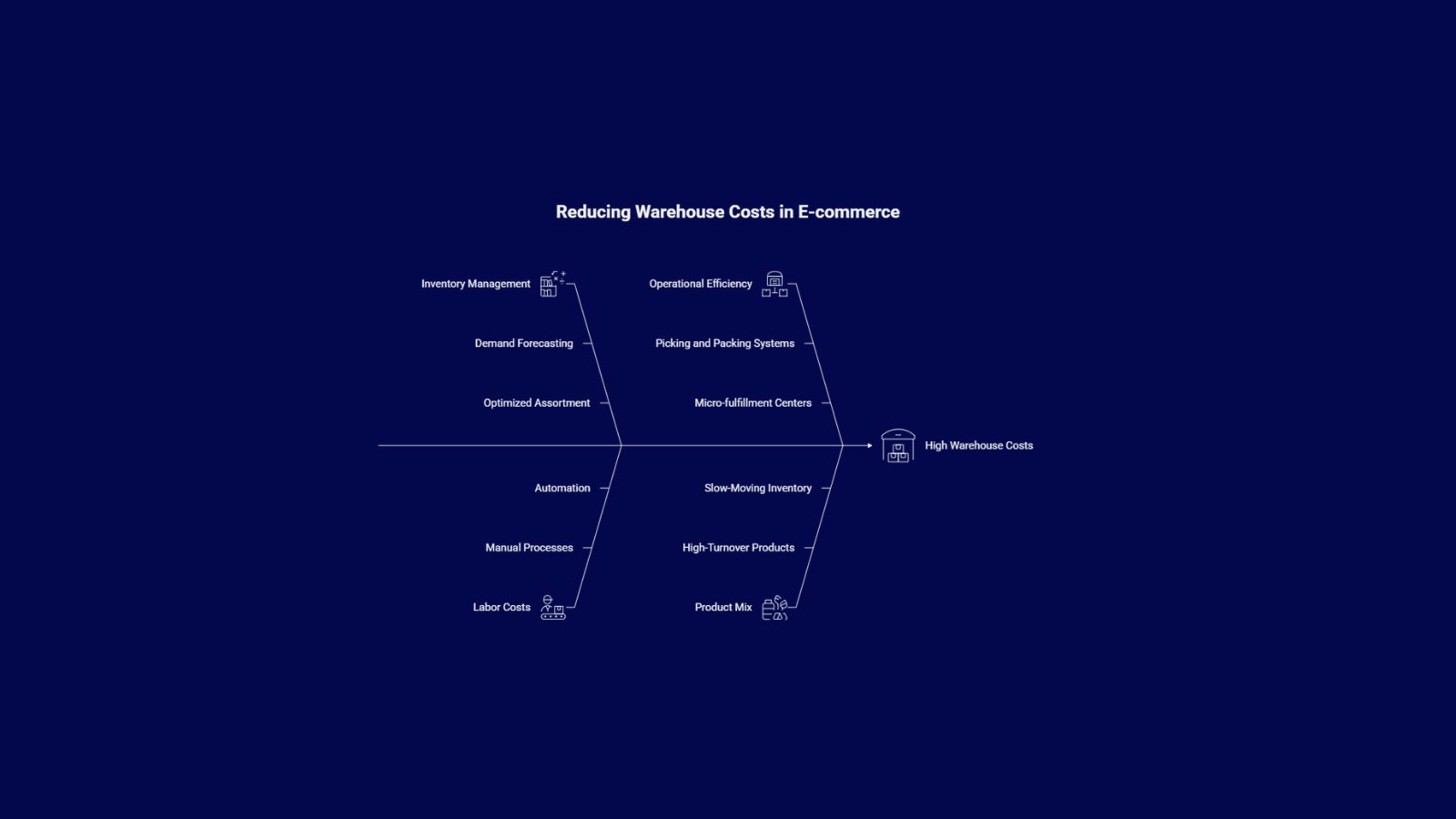

What Operational Efficiencies Cut Down Warehouse Costs?

Once we tackle delivery, the focus shifts to the dark store itself, the engine room. Efficiency here directly reduces labor costs and, crucially, inventory waste.

A huge chunk of the expense base is tied up in inventory and the workforce needed for picking and packing. Getting demand prediction right and optimizing the product mix are absolutely essential to controlling these costs.

Tactics to improve operational efficiency and inventory management include:

- Demand Forecasting: We need sophisticated data science to accurately predict consumer demand at a hyper-local level. This is crucial for minimizing inventory waste, especially for perishable, high-cost goods that can quickly spoil if stock isn’t managed perfectly.

- Optimized Assortment: Forget the vast e-commerce catalog. Quick commerce profitability is driven by focusing on a smaller, higher-turnover selection of essential and high-margin products. This simplifies picking and frees up capital tied up in slow-moving inventory.

- Automation: Implementing automated picking and packing systems within micro-fulfillment centers is the future. This speeds up order preparation, reduces our reliance on manual processes, and ultimately lowers the direct labor costs per order.

Beyond Cost Cutting: How Do We Boost the Revenue Side?

You can’t just cut your way to a billion-dollar valuation. True sustainable growth requires “basket boosters” and diverse income streams. As sellers, we know the margin per order is everything.

Maximizing the Average Order Value (AOV)

Quick commerce baskets are notoriously small, often just a few impulsive items. To achieve profitability, we need that basket size to be much, much bigger. The industry has landed on a necessary AOV target that must consistently be reached and surpassed, often cited as €40 or its equivalent.

Basket size depends on items per order, price per item, and variable customer fees. The challenge is combining these without making the customer feel gouged or overstretched.

Key strategies to increase AOV and basket size include:

- Minimum Order Values: Setting a minimum spend required to qualify for free or standard delivery. This immediately weeds out unprofitable micro-orders.

- Upselling and Cross-selling: Strategically offering premium or complementary product recommendations directly in the app. If a customer is buying pasta, suggest €5 pesto sauce.

- Product Bundling: Combining related, high-margin products into value bundles (like a “Taco Night Kit”). This increases the basket size while making the customer feel like they’re getting a deal.

Diversified Income Streams Supporting Long-Term Profitability

Relying solely on product margins and delivery fees is a quick path to going under. The smartest players see their customer base, data, and fleet as assets that can generate secondary revenue.

This shift from being just a retailer to a logistics and media company is crucial. These additional revenue streams help absorb a greater share of those immovable fixed costs.

Additional sources of income essential for self-sustainability include:

- Advertising Income: We have incredibly valuable customer data. Generating revenue from brands for premium in-app product placement and promotions is a huge opportunity, leveraging that data for targeted visibility.

- Subscription Models: Implementing loyalty programs with membership fees. These models offer delivery perks and, crucially, boost customer retention and order frequency, massively increasing the Customer Lifetime Value (CLV).

- Delivery-as-a-Service (DaaS): Utilizing the existing in-house fleet, which often has idle capacity between peak times, to perform deliveries for other local businesses or retail partners. It turns a fixed asset into a flexible revenue generator.

Conclusion: The Path to Sustainable Growth

The days of simply throwing cash at the quick commerce problem are finished. The only path forward for surviving players is a ruthless, data-driven commitment to mastering unit economics. This means simultaneously optimizing the high variable cost of last-mile delivery and boosting revenue through larger basket sizes and diversified income streams like advertising.

By strategically pulling these key cost and revenue levers, companies can overcome the pressure of high fixed costs and intense competition. This focus on operational efficiency and sustainable growth is already reshaping the market, positioning the players who achieve operational profitability today for long-term dominance. For all sellers, the key takeaway is this: efficiency is the new engine of growth.

Are you a seller looking to optimize your e-commerce operations and logistics? Understanding unit economics is the foundation of long-term success, whether you operate a traditional e-commerce model or a rapid delivery service.

Gain the insights and tools needed to build a resilient, profitable, and scalable business. Visit Base.com today to explore resources and solutions designed to put your business on a sustainable growth trajectory.

Click here to read more about what is driving the rise of D2C brands in India and how technology enables their growth.

Frequently Asked Questions (FAQ)

1. What is the primary operational hurdle for achieving quick commerce profitability?

The largest single operational hurdle is the cost of last-mile delivery. To solve this, players must maximize order density at the dark store level (aiming for 300–400 orders/day) and aggressively optimize routes and store locations to minimize delivery distance.

2. What is the target Average Order Value (AOV) for quick commerce sustainability?

For quick commerce companies to achieve profitability, the average order value (AOV) must consistently reach and stay above €40 (or its equivalent in other currencies). This basket size is necessary to cover the combined fixed and variable costs of the rapid model.

3. What inventory strategy helps reduce wastage and improve margins in quick commerce?

The most effective strategy is a tightly controlled micro-inventory model built on real-time demand forecasting. Dark stores must carry only the top 1,500–2,000 SKUs that drive 80–85% of local demand. This reduces expiry-led wastage, improves stock turns, and ensures that working capital is deployed only on high-velocity items.