The Indian e-commerce market is a high-speed engine of growth. With millions of transactions occurring daily across state lines, the Goods and Services Tax (GST) regime is the backbone that keeps this colossal system functioning legally and efficiently. For every Indian e-commerce seller, generating a GST-compliant invoice is not a mere clerical task; it is the single most critical process that determines their profitability, legal standing, and ability to scale.

This exhaustive guide details why robust, automated GST invoicing is non-negotiable for online retailers and how it shapes the entire financial health of the business.

How does invoicing ensure GST compliance for e-commerce sellers?

GST was introduced to create a “One Nation, One Tax” system, eliminating the cascading effect of multiple taxes. For an e-commerce seller, who typically sells across different states (Inter-State Supply), this requires meticulous record-keeping governed by the invoice.

Key Pillars of GST Compliance Driven by the Invoice

- Correct Tax Determination (IGST vs. CGST/SGST): The invoice is the legal document that confirms the Place of Supply.

- If the seller and buyer are in different states, the invoice must levy IGST (Integrated GST).

- If the seller and buyer are in the same state, the invoice must levy CGST + SGST (Central and State GST).

- Error in this simple determination leads to immediate non-compliance, requiring reversal and penalties.

- Tax Collected at Source (TCS) Reconciliation: E-commerce operators (like Amazon or Flipkart) are required to deduct TCS (currently 1%) on net taxable supplies made by sellers. The seller’s ability to claim this credit depends entirely on the accuracy of the invoice data matching the data uploaded by the e-commerce operator in their GSTR-8 return.

- Input Tax Credit (ITC) Claim: The supplier’s GST-compliant sales invoice becomes the buyer’s (the customer’s or a B2B recipient’s) purchase document for claiming ITC. If a seller’s invoice is incorrect, their B2B customer cannot claim ITC, which ruins the supplier-customer relationship and leads to business loss.

- E-Way Bill Generation: For transportation of goods exceeding ₹50,000 (with some exceptions), an E-Way Bill is mandatory. This bill is generated based on the details and value mentioned in the GST tax invoice. A non-compliant or erroneous invoice invalidates the E-Way Bill, leading to the detention and seizure of goods in transit.

What are the risks that cripple e-commerce businesses when they fail to maintain GST-compliant invoicing?

The penalties for failure to issue a proper GST-compliant invoice or for issuing an incorrect one are severe, posing an existential threat to growing e-commerce ventures.

Financial and Legal Consequences of Invoicing Errors

| Type of Violation | Penalty for E-Commerce Sellers | Business Impact |

|---|---|---|

| Failure to Issue a Tax Invoice | Higher of 100% of the tax due or ₹10,000 per instance (Section 122). | Loss of B2B customers, severe cash flow disruption, and high risk of audit. |

| Issuing an Incorrect Invoice | Flat penalty of ₹25,000 per incorrect invoice. | Common for errors in GSTIN, HSN/SAC code, or tax rate. Leads to audit risk and customer disputes. |

| Transporting Goods Without Valid E-Way Bill/Invoice | Detention and seizure of goods. Penalty of 200% of the tax payable or ₹25,000, whichever is lower. | Major supply chain disruption, reputational damage, and massive financial loss on inventory. |

| Falsification/Suppression of Records | Jail terms up to 5 years and fine, depending on the tax amount evaded (Exceeding ₹500 lakhs). | Highest level of legal and criminal consequence. |

| Loss of ITC for Customer | The customer denies payment or demands compensation. | Loss of future B2B contracts, damage to business credibility. |

How can E-commerce Sellers get out of this Invoicing Complications?

Given the complexity, high transaction volumes, and dynamic nature of e-commerce, manual invoicing is entirely unsustainable. Automation is the only pathway to achieving 100% GST compliance.

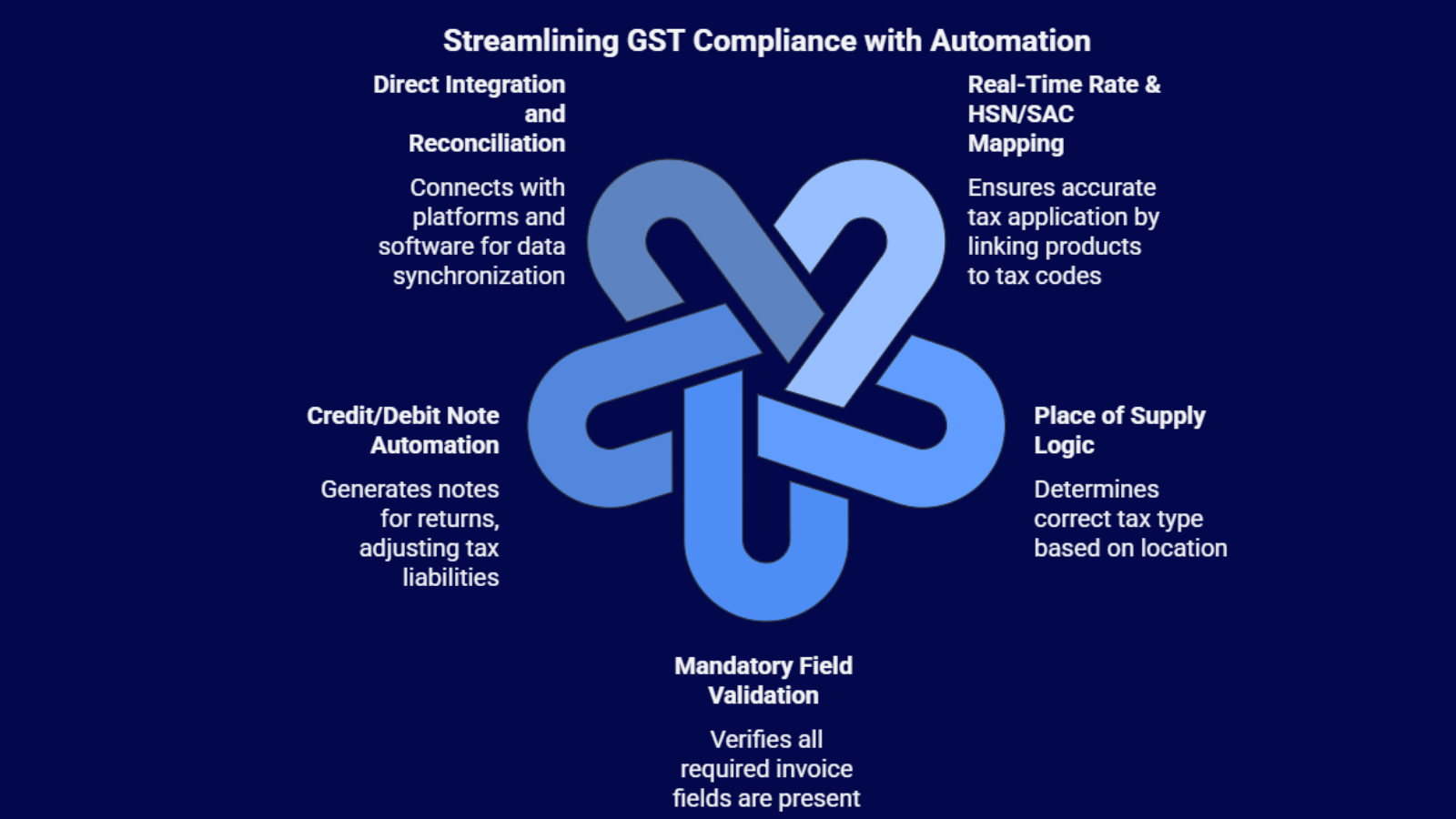

How Automated Systems Ensure Full Compliance

- Real-Time Rate & HSN/SAC Mapping: The software maintains a central database of all products linked to their corresponding HSN (Harmonized System of Nomenclature) or SAC (Service Accounting Code) and the current GST rate. When an order is processed, the system auto-applies the correct tax rate, eliminating human error.

- Place of Supply (POS) Logic: The system uses the shipping pin code to instantly determine the Place of Supply. It then automatically decides to charge IGST (Inter-State) or CGST + SGST (Intra-State) based on the seller’s registered state versus the buyer’s state.

- Mandatory Field Validation: Automated software ensures every mandatory field for a valid tax invoice is present:

- Seller’s and Buyer’s GSTIN.

- Unique Invoice Number and Date.

- HSN/SAC Code.

- Taxable Value, Tax Rate, and Tax Amount (CGST, SGST, IGST).

- Without automation, missing any of these on a high volume of orders is inevitable.

- Credit/Debit Note Automation: When a customer returns a product, the system automatically generates a Credit Note as per GST rules to reverse the original transaction, ensuring tax liability is correctly adjusted.

- Direct Integration and Reconciliation: Advanced software integrates directly with:

- E-commerce Platforms: To pull sales order data.

- Accounting Software (ERP): To update the ledger in real-time.

- GST Portal (via GSP): To facilitate easy filing of GSTR-1 (Sales) and GSTR-3B (Summary), ensuring that the data being filed matches the invoice data.

What are the operation challenges that automating invoicing also solves?

Compliance is the floor, but the operational advantages of automated GST invoicing are the ceiling for e-commerce growth.

| Business Function | Benefit of Automated GST Invoicing | Impact on Growth |

|---|---|---|

| Cash Flow | Facilitates faster, error-free Input Tax Credit (ITC) claims on purchases, reducing the working capital blocked as tax. | Improved Liquidity: More cash available for marketing and inventory. |

| Audits & Scrutiny | Provides a complete, clean, and digitized audit trail with all invoices stored securely and linked to returns. | Reduced Audit Risk: Effortless handling of departmental queries and scrutiny. |

| Customer Trust (B2C) | Ensures customers receive clear, professional, and legally valid tax invoices, especially crucial for electronics and high-value items. | Enhanced Reputation: Builds trust and encourages repeat purchases. |

| B2B Expansion | Error-free invoices guarantee the recipient can claim their ITC, making the seller a preferred vendor for business buyers. | Wider Market Access: Unlocks high-volume corporate and reseller contracts. |

| Time Efficiency | Reduces the time spent on manual data entry, calculation, and reconciliation from days to minutes. | Increased Productivity: Allows finance teams to focus on strategy instead of repetitive compliance tasks. |

Via Base.com, you can directly integrate with Zoho and start your invoicing journey today!

Conclusion

For Indian e-commerce sellers, GST-compliant invoicing is the most vital operation in the business. It is the gatekeeper of the supply chain, the source of Input Tax Credit, the proof of legal sale, and the foundation for all tax returns (GSTR-1, GSTR-3B).

By transitioning from manual chaos to automated, intelligent invoicing, sellers not only secure their legal position but also unlock significant efficiencies that directly fuel higher sales and sustainable profitability in India’s highly competitive digital market.

Your growth depends on your compliance. Start automated GST invoicing with Base.com today.

Don’t let manual errors or outdated systems expose your e-commerce business to crippling penalties and lost B2B opportunities. The time spent manually reconciling marketplace data is time lost on scaling your business. Transform your e-commerce compliance into a competitive advantage. Implement an automated, intelligent GST invoicing solution today.

Learn more about seamless GST automation and start your compliance check at base.com.

Frequently Asked Questions (FAQs) for Indian Sellers

Q1: What is the most common mistake in GST invoicing for new e-commerce sellers?

A1: The most common mistake is applying the wrong tax type: charging CGST and SGST on an inter-state sale (where IGST is required), or vice-versa. Since e-commerce inherently involves pan-India shipping, correctly determining the Place of Supply for every order is critical and is best handled by automated software using the customer’s shipping address.

Q2: My annual turnover is low. Do I still need a comprehensive GST invoicing software?

A2: While the turnover threshold for mandatory GST registration has general exemptions, it does not apply to sellers making supplies through an E-Commerce Operator (ECO). If you sell on Amazon, Flipkart, or similar platforms, you are generally required to register for GST regardless of turnover and, consequently, must issue GST-compliant tax invoices. Automation becomes essential the moment you handle more than a few hundred orders a month to ensure accuracy and timely filing.

Q3: Does a ‘Bill of Supply’ apply to e-commerce, or just a ‘Tax Invoice’?

A3: A registered e-commerce seller generally issues a Tax Invoice. A Bill of Supply is issued only in two main cases: 1) when the seller is a Composition Scheme dealer, or 2) when the seller is supplying exempted goods or services. For the vast majority of regular e-commerce products, the seller must issue a proper Tax Invoice.

Q4: How does a GST invoice help me with product returns?

A4: When a product is returned by a customer, the original GST collected must be reversed. A compliant invoicing system handles this by automatically generating a Credit Note. This Credit Note is the legal document that allows the seller to reduce their original sales liability (GSTR-1) and correctly account for the return, ensuring they don’t overpay tax on the canceled sale.