Learn how Indian e-commerce sellers can stay GST-compliant in 2025. Covers new slabs, invoicing, ITC, filing, and Base.com automation tips for seamless updates.

The Indian e-commerce industry in 2025 continues to expand rapidly with platforms such as Amazon, Flipkart, Meesho, and Myntra driving digital trade across metros and smaller cities. Independent sellers are also contributing to this growth, but tax compliance has become a central concern with each change in regulation.

The Goods and Services Tax (GST) has been in place for more than eight years and in 2025 sellers face one of the most significant rounds of changes so far. The 56th GST Council Meeting in September 2025 revised several slabs, reducing the rates on essentials such as paneer, dairy products, footwear, and common FMCG items while increasing the rates on luxury and sin goods including pan masala, cigarettes, and caffeinated beverages. These changes will apply from 22 September 2025, and sellers are preparing for the operational impact.

Three areas of worry are commonly raised by sellers:

- Adjusting product prices in time for the new slabs.

- Ensuring invoices and filings match the revised rates to avoid compliance errors.

- Managing cash flow, especially in cases where input taxes are higher than output taxes and refunds are expected through the new provisional refund mechanism.

- Purchase Orders must reflect correct GST rates; mismatched supplier invoices can block ITC and disrupt compliance.

In this environment GST compliance is no longer a static process. It requires constant updates and careful alignment between product categories, tax slabs, and reporting obligations. Mistakes can lead to penalties, working capital blockages, or disputes with tax authorities.

This guide offers a structured approach for Indian e-commerce sellers to manage GST compliance in 2025. It explains the key rules and obligations, the impact of the September 2025 Council decisions, and the role of inventory and order management systems such as Base.com in supporting tasks like bulk product uploads, GST slab allocation, compliant invoicing, and report generation. The focus is on helping sellers prepare for the 22 September deadline and beyond with clarity and confidence.

Understanding GST for E-commerce Sellers 2025 Edition

The Goods and Services Tax (GST) regime in India has reached a new phase in 2025, with the 56th GST Council Meeting (3rd September 2025) introducing sweeping reforms. For e-commerce sellers, this marks one of the most critical transitions since GST was first introduced in 2017. The changes that will take effect from 22nd September 2025 will directly influence product pricing, invoicing, input tax credit calculations, and consumer demand across industries.

This section provides a detailed industry-wise breakdown of GST changes, their implications, and what sellers on marketplaces and platforms like Base.com need to prepare for.

What is GST?

The Goods and Services Tax (GST) is a destination-based indirect tax applied on the supply of goods and services. It replaced earlier state and central taxes such as VAT, excise duty, and service tax, creating a single national framework.

For e-commerce sellers, GST offers four major advantages:

- Uniform rates across states, eliminating cascading taxes.

- Simplified interstate trade by removing entry barriers.

- Transparent invoicing, improving buyer confidence.

- Input Tax Credit (ITC) benefits that reduce overall tax liability.

What are the GST Registration Requirements?

For Goods Sellers:

- GST registration is mandatory, regardless of turnover. Even if a seller lists only one SKU on Amazon or Flipkart, they must have a GSTIN.

For Service Sellers:

- GST applies if annual turnover exceeds ₹20 lakh.

- Exceptions under Section 9(5) of CGST Act, where liability shifts to the operator, include:

- Ride-sharing (Uber, Ola).

- Hotel bookings via aggregators (Yatra, OYO).

- Home services (Urban Company).

Note: Composition Scheme is not permitted for e-commerce sellers.

Who is an E-commerce Seller?

Under GST, an e-commerce seller is defined as any person or business selling goods or services through digital or electronic platforms. This includes marketplaces like Amazon, Flipkart, Meesho, Myntra, as well as independent webstores.

Key clarifications for sellers:

- A seller may operate offline and online simultaneously. GST applies equally to both sales channels.

- All marketplace sellers must register under GST, irrespective of turnover. This ensures uniform compliance across platforms.

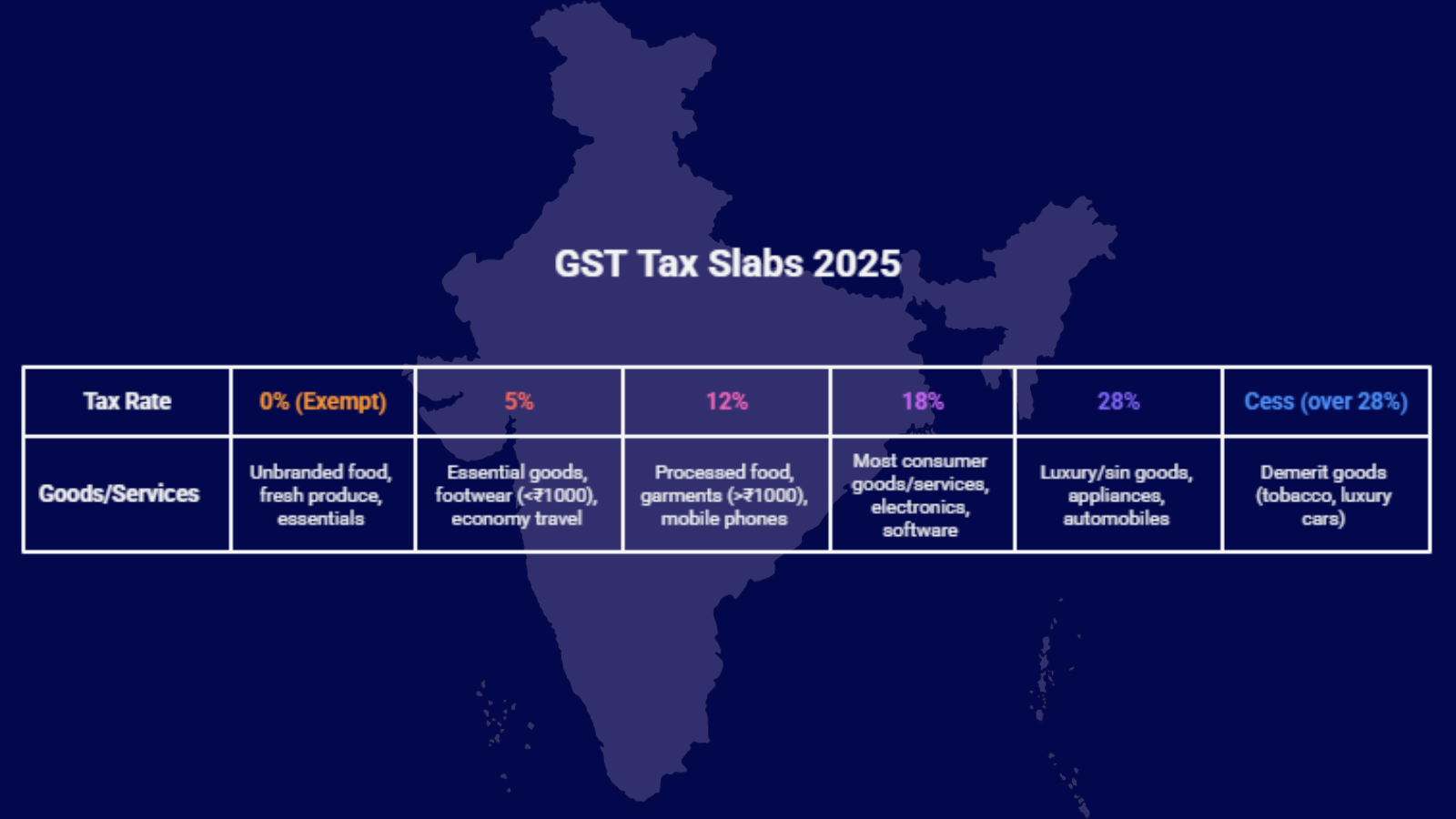

What are the GST Slabs Relevant to E-commerce in 2025?

The 56th GST Council Meeting (Sept 2025) introduced the most significant slab changes since GST’s launch. The reforms largely focus on reducing rates for daily-use essentials and MSME-friendly categories, while increasing them for luxury and sin goods.

Industry-Wise GST Changes

| Category | GST Change | Impact on Sellers |

|---|---|---|

| 1. Food & Beverages | Paneer, cheese, UHT milk, pasta, biscuits, chocolates, ice cream, ready-to-eat foods reduced from 12%/18% → 5% | FMCG brands and grocery sellers (Amazon Pantry, BigBasket, Flipkart Grocery, Meesho) can lower prices and boost sales. D2C food startups gain competitiveness. SKUs must be re-tagged with new HSN-linked rates. |

| 2. Personal Care & Household Essentials | Soaps, shampoos, detergents, hygiene products reduced from 18% → 5% | Beauty and personal care sellers (Nykaa, Amazon Beauty, Flipkart Health+) see higher demand. Margins improve if ITC is claimed. Bundles/combos must be recalculated in Base.com. |

| 3. Apparel, Textiles & Footwear | Footwear <₹2500 reduced from 12% → 5%. Certain textiles rationalized. | Small sellers (Myntra, Ajio, Meesho) gain an affordability edge. Tier 2/3 footwear sellers benefit. Must track threshold-based GST (below ₹2500 = 5%, above = 18%). |

| 4. Electronics & Appliances | No change: Electronics remain at 18%. | No relief for consumer electronics sellers. ITC reconciliation remains critical, especially for imports. Discounts do not alter the GST slab here. |

| 5. Luxury & Sin Categories | Pan masala, gutkha, cigarettes, caffeinated drinks, luxury cars, yachts, private aircraft increased from 28% → 40% | Sellers face reduced demand and higher compliance. Brands may need to absorb part of the tax hike. Marketplaces are likely to impose stricter oversight. |

| 6. Healthcare & Medical Devices | Certain diagnostic kits and medical equipment reduced to 5%. | Online pharmacies and B2B health suppliers (Pharmeasy, Tata 1mg) benefit. Sellers pass savings to hospitals, labs, and consumers. |

| 7. Renewable Energy & Sustainable Products | Solar panels, wind energy devices, EV-related equipment reduced to 5%. | Sellers on B2B platforms (IndiaMART, Udaan) gain demand. Supports government sustainability push and creates export opportunities. |

What are the Implications for E-commerce Sellers?

India’s e-commerce sector now counts over 1.2 million active online sellers, with festive periods contributing up to 35 – 40% of their annual revenue. Any GST revision directly affects pricing, margins, and buyer sentiment across these sellers. The September 2025 changes create immediate implications for catalog updates, invoicing accuracy, and compliance readiness.

1. Repricing and Labeling

- Update every SKU with the revised GST slab.

- Re-tag product catalogs with correct HSN codes and tax rates.

- Ensure labels, invoices, and digital descriptions carry accurate GST details.

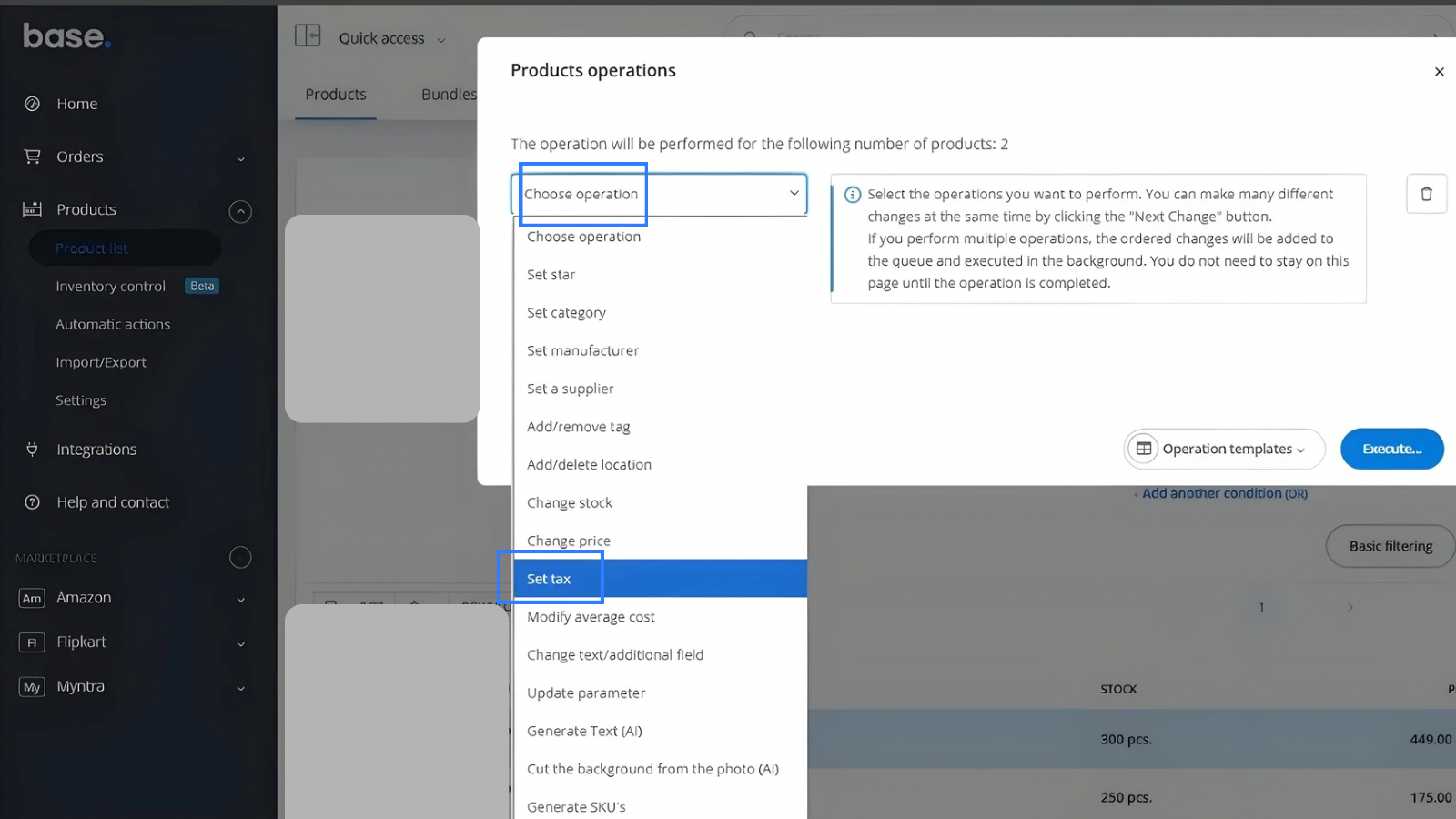

- Use bulk upload features in systems (like Base.com) to update rates across marketplaces consistently.

Why it matters: Incorrect GST on invoices may lead to penalties, rejected ITC claims, and disputes with marketplaces or customers.

2. Consumer Demand Shifts

- Essentials and FMCG items moving to 5% GST will see higher demand and sales volumes.

- Luxury and sin goods now taxed at 40% will likely face reduced demand.

- Sellers must anticipate these shifts, stock essentials adequately, and adjust pricing strategies for premium goods.

Why it matters: Proper planning prevents stockouts in high-demand categories and overstocking in low-demand ones.

3. Input Tax Credit (ITC) Optimization

- Purchases made at higher GST rates before 22 September must be reconciled with sales made after the revision.

- Maintain proper documentation and align claims with GSTR-2B.

- Sellers should ensure their systems track ITC efficiently to avoid manual errors.

Why it matters: ITC mismatches can block credits, causing cash flow problems and penalties.

4. Operational Pressure Around 22 September

- Orders placed before 22nd but invoiced after must reflect the new GST rates.

- Bulk updates in systems reduce the risk of mismatched invoices.

- Expect increased customer queries and disputes if invoices differ from listed prices.

- Train staff and communicate changes to customers in advance.

Why it matters: Transition-day mistakes can result in financial penalties, reputational damage, and order cancellations.

Seller Readiness Checklist for 22 September 2025

The GST slab revisions announced in the 56th GST Council Meeting (3rd September 2025) will take effect from 22nd September 2025. For e-commerce sellers, this date represents more than just a compliance requirement, it is a transition point where catalog accuracy, invoice precision, and operational readiness will be tested.

Here is the detailed readiness checklist every seller should follow:

1. Update HSN Codes with Correct New Slabs in Product Catalog

- Review every SKU in your catalog and ensure it is tagged with the correct HSN (Harmonized System of Nomenclature) code and the revised GST slab.

- Incorrect HSN codes or mismatched GST rates can result in invoice errors, marketplace penalties, and difficulties during GST return filing.

- How to execute:

- Download the updated HSN and GST rate list from the GST portal.

- Cross-check with your product categories.

- Use a bulk upload feature in systems like Base.com to apply changes across all SKUs at once.

2. Validate Bulk Uploads in Systems to Avoid Misclassification

- After uploading revised GST rates, validate that every SKU is mapped correctly, especially those with threshold-based GST (like footwear under vs. over ₹2500).

- Even one misclassified SKU can lead to mass invoicing errors, resulting in penalties and ITC rejections.

- How to execute:

- Run test invoices on random SKUs across categories.

- Check the GST applied matches the updated slab.

- Lock the updated catalog in your system before 22nd September.

3. Reconcile Pending Invoices to Avoid Mismatches in GSTR-1 and GSTR-3B

- Clear any backlog of invoices generated before 22nd September, ensuring that sales before the change are filed at old rates, and post-22nd invoices reflect new rates.

- Mixing pre- and post-change invoices can lead to mismatches between GSTR-1 (sales return) and GSTR-3B (liability summary). This may trigger GST notices or ITC denial.

- How to execute:

- Generate reconciliation reports from your inventory system.

- File pending returns (GSTR-1/3B) for the previous month or quarter before the transition.

- Tag invoices clearly by date to separate pre-change vs. post-change transactions.

4. Train Teams to Handle Threshold-Based Products

- Educate your sales, operations, and finance teams about slab differences for threshold-driven categories. Example: footwear below ₹2500 = 5% GST, while footwear above ₹2500 = 18%.

- Teams may unknowingly apply the wrong slab during invoicing or discount campaigns, leading to compliance errors.

- How to execute:

- Create a quick reference sheet of products affected by thresholds.

- Run a short training session for staff involved in catalog management, invoicing, and order processing.

- Simulate scenarios such as applying discounts that push an SKU below a threshold.

5. Communicate Pricing Changes to Customers Early

- Inform customers about any price changes caused by revised GST rates before the 22nd September deadline.

- Unexpected price hikes in luxury categories or drops in essentials may confuse customers, leading to disputes, cart abandonment, or negative reviews.

- How to execute:

- Update product pages with new prices in advance.

- Send out communication via email, app notifications, or store announcements.

- For B2B sellers, inform wholesale buyers early so they can plan procurement.

How Base.com Helps:

- Each product in Base is tagged with the correct HSN (Harmonized System of Nomenclature) code via PIM (Product Information Management).

- The system automatically maps the appropriate GST slab to each SKU.

- When GST slabs are revised, Base updates them centrally, ensuring all SKUs reflect the changes.

- This process eliminates manual errors and keeps invoicing and reporting compliant across marketplaces.

GST Compliance Obligations for Sellers

GST compliance in India is not a one-time activity. For e-commerce sellers, it involves continuous obligations around invoicing, return filing, handling TCS and TDS deductions, and optimizing Input Tax Credit (ITC). Missteps can lead to penalties, blocked credits, marketplace suspension, or reputational harm.

This section breaks down each compliance obligation in detail and explains how sellers can meet them efficiently.

A. Mandatory Invoicing

Every e-commerce seller registered under GST must issue GST-compliant invoices for every sale.

Invoice Requirements:

- GSTIN of the seller and, if applicable, the buyer.

- HSN/SAC code for each product or service.

- Rate and amount of GST charged, split into CGST, SGST, and IGST where applicable.

- Place of supply to determine whether the transaction is interstate or intrastate.

- Invoice number and date in sequential order.

- Details of taxable value, discounts, and total invoice amount.

Why it matters:

- Non-compliant invoices can result in rejection of ITC for the buyer and penalties for the seller.

- Marketplaces like Amazon, Flipkart, and Myntra require sellers to upload only GST-compliant invoices.

Best Practices:

- Use standardized templates approved by the GST Council.

- Maintain digital copies of all invoices for at least 72 months.

- For exports, issue zero-rated invoices separately.

B. GST Returns Filing

E-commerce sellers are required to file multiple returns under GST. The frequency depends on turnover and scheme opted.

Types of Returns:

- GSTR-1

- Statement of outward supplies (sales).

- Frequency: monthly or quarterly (under QRMP scheme if turnover ≤ ₹5 crore).

- Due dates:

- Monthly: 11th of the following month.

- Quarterly: 13th of the month following the quarter.

- GSTR-3B

- Summary of outward and inward supplies, ITC claimed, and tax liability.

- Due date: 20th of the following month (monthly), or 22nd/24th for quarterly filers.

- GSTR-9

- Annual return required if turnover > ₹2 crore.

- Includes consolidated details of outward and inward supplies, ITC, and tax liability.

- Due date: 31st December following the financial year.

- GSTR-9C

- Reconciliation statement required if turnover > ₹5 crore.

- Must be self-certified and filed along with GSTR-9.

Why it matters:

- Delays in filing attract late fees (₹50 per day, or ₹20 per day for nil returns) and interest (18% per annum).

- Mismatches between GSTR-1 and GSTR-3B often trigger notices from GST authorities.

Best Practices:

- Reconcile data with marketplace reports (Amazon, Flipkart) before filing.

- Use systems to auto-generate return-ready reports.

- Always cross-check ITC claims with GSTR-2B.

C. TCS (Tax Collected at Source)

Under GST, e-commerce operators are required to collect TCS from sellers on every transaction.

Key Points:

- TCS rate: 1% of net taxable sales (0.5% CGST + 0.5% SGST, or 1% IGST).

- Deductions by operators like Amazon, Flipkart, Meesho, etc., at the time of payment to sellers.

- Example: If monthly sales = ₹10,00,000, Amazon deducts ₹10,000 as TCS before releasing settlement.

Claiming TCS Credit:

- Sellers can claim TCS credit while filing GST returns.

- The amount deducted is reflected in the seller’s GST portal ledger.

Why it matters:

- Failure to reconcile TCS may lead to under-reporting of tax credits.

- Sellers relying on marketplaces for the majority of sales must regularly track deductions.

Best Practices:

- Download TCS reports from marketplaces monthly.

- Match marketplace TCS with your own sales records.

- Claim credit in GSTR-3B to offset liability.

D. TDS (Tax Deducted at Source)

TDS provisions under GST are separate from income tax TDS. They apply when specified e-commerce operators deduct tax from sellers.

Key Points:

- TDS rate: 1% on gross sales if annual sales exceed ₹5 lakh.

- If PAN/Aadhaar is not furnished, the deduction increases to 5%.

- TDS is not applicable to non-resident sellers.

- Deduction happens at the time of crediting payment to the seller or at payment time, whichever is earlier.

Why it matters:

- Incorrect or missing PAN/Aadhaar details can lead to higher deductions.

- TDS deductions directly impact seller cash flow.

Best Practices:

- Always update PAN and Aadhaar with marketplace operators.

- Track gross sales across platforms to check if threshold is crossed.

- Claim TDS credits during GST return filing.

E. Input Tax Credit (ITC)

The ITC mechanism is one of the most important features of GST. It allows sellers to offset the tax they pay on inputs against the tax they collect on sales.

Eligibility Conditions:

- Suppliers must be GST registered.

- The seller must hold a valid tax invoice.

- Goods or services purchased must be used for business purposes.

- Seller must have filed GSTR-3B.

Examples of Eligible ITC for E-commerce Sellers:

- GST paid on packaging materials (boxes, bubble wrap).

- GST on logistics (courier, shipping services).

- GST on raw materials for manufacturing or assembling products.

Blocked ITC (not allowed):

- GST on personal expenses, employee food or entertainment.

- GST on motor vehicles (unless used for transport business).

- GST on goods used for exempt supplies.

Why it matters:

- ITC reduces overall tax liability and improves profitability.

- Mismatches between ITC claims and GSTR-2B often result in notices.

Best Practices:

- Reconcile purchase invoices monthly with GSTR-2B.

- Maintain digital records of all invoices for audits.

- Avoid claiming ITC on blocked credits.

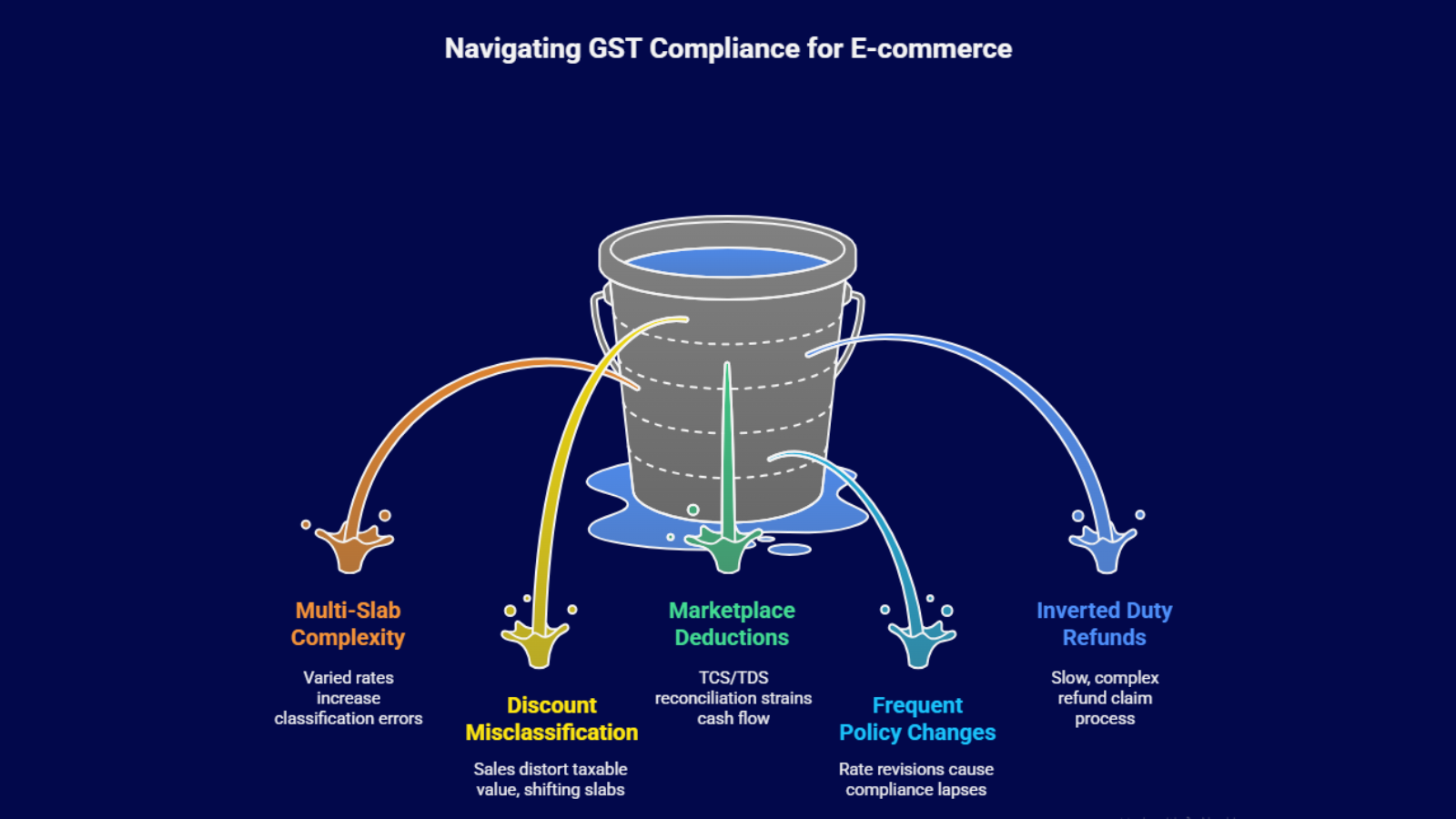

What are the Challenges in GST Compliance for E-commerce Sellers?

GST compliance is now one of the most demanding aspects of managing an e-commerce business in India. Unlike traditional retail, online sellers must navigate multiple product categories, cross-border state transactions, and diverse marketplace policies. This environment creates layered obligations such as accurate invoicing, correct product classification, reconciliation of marketplace deductions, and constant adaptation to evolving rules.

The 56th GST Council Meeting in September 2025 has intensified this challenge by announcing major slab revisions for essentials and luxury goods. With these changes coming into force on 22nd September 2025, sellers are under pressure to update catalogs, align invoicing systems, and prepare for a transition that directly affects compliance and profitability.

1. Multi-slab complexity

E-commerce sellers often manage products across categories like fashion, food, and electronics, each with different GST slabs (5%, 12%, 18%, 40%). Accurate classification is critical; missteps can cause tax errors and penalties.

2. Discount-driven misclassification

Heavy discounts during sales can alter a product’s taxable value and shift it into a new GST slab. For example, footwear above ₹2500 (18%) discounted below the threshold may fall under 5%. Sellers must closely monitor such scenarios.

3. Marketplace deductions

Operators like Amazon and Flipkart deduct 1% TCS and sometimes 1% TDS before payouts. Reconciling these deductions with GST returns is challenging and can affect cash flow if credits are delayed.

4. Frequent policy changes

GST slabs are revised frequently. In September 2025, FMCG and essentials saw reduced rates, while luxury and sin goods were taxed higher. Sellers must quickly update catalogs, invoices, and returns to avoid compliance lapses.

5. Inverted duty refunds

When input taxes are higher than output taxes, sellers are eligible for refunds. However, the process is document-heavy and slow despite new provisional refund provisions.

How to Do Bulk Upload of GST Data in Base.com?

Bulk uploading GST data in Base.com is one of the most important features for sellers who manage large and diverse product catalogs. Instead of updating GST information product by product, sellers can prepare structured files that allow quick and accurate uploads at scale.

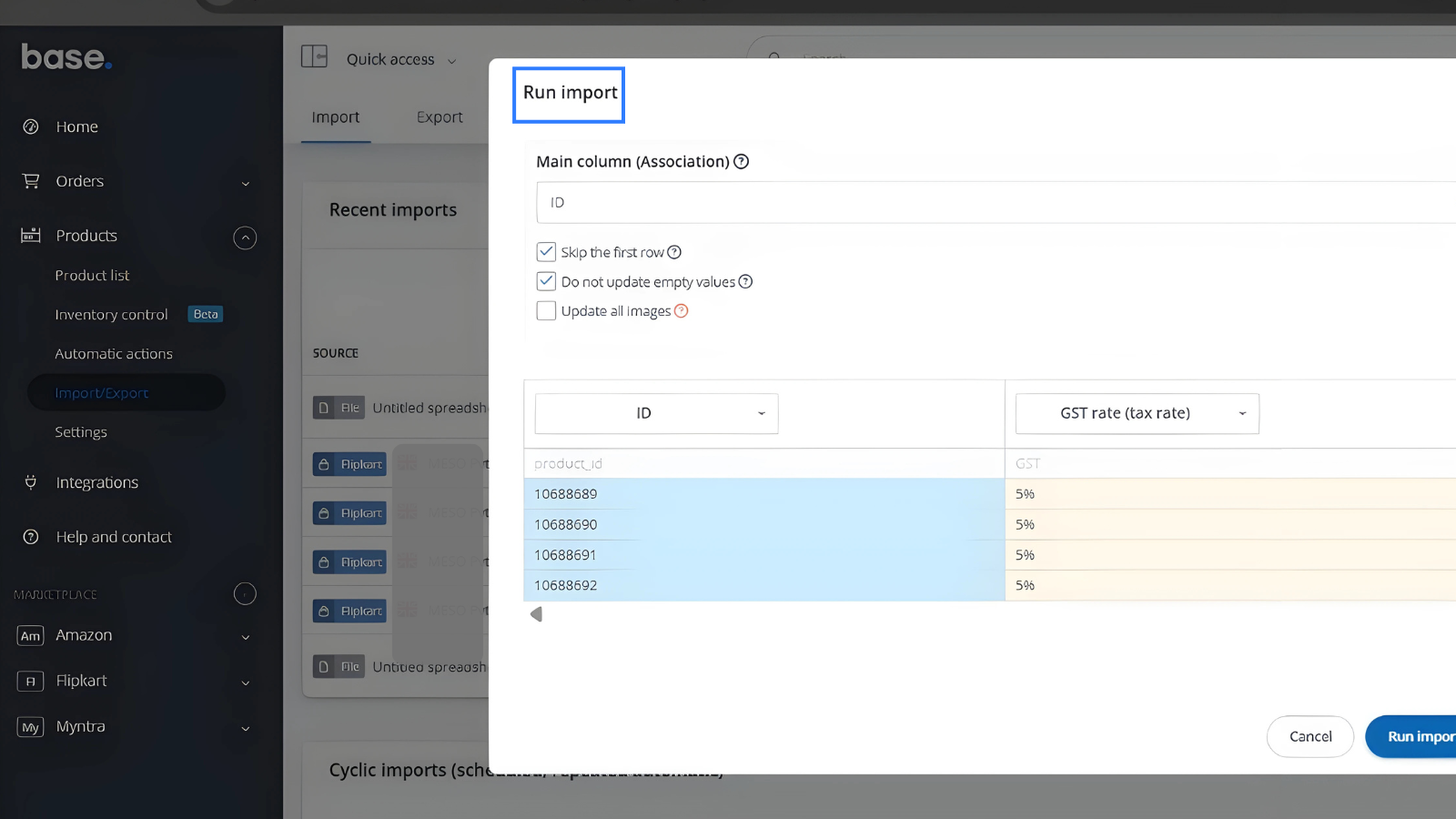

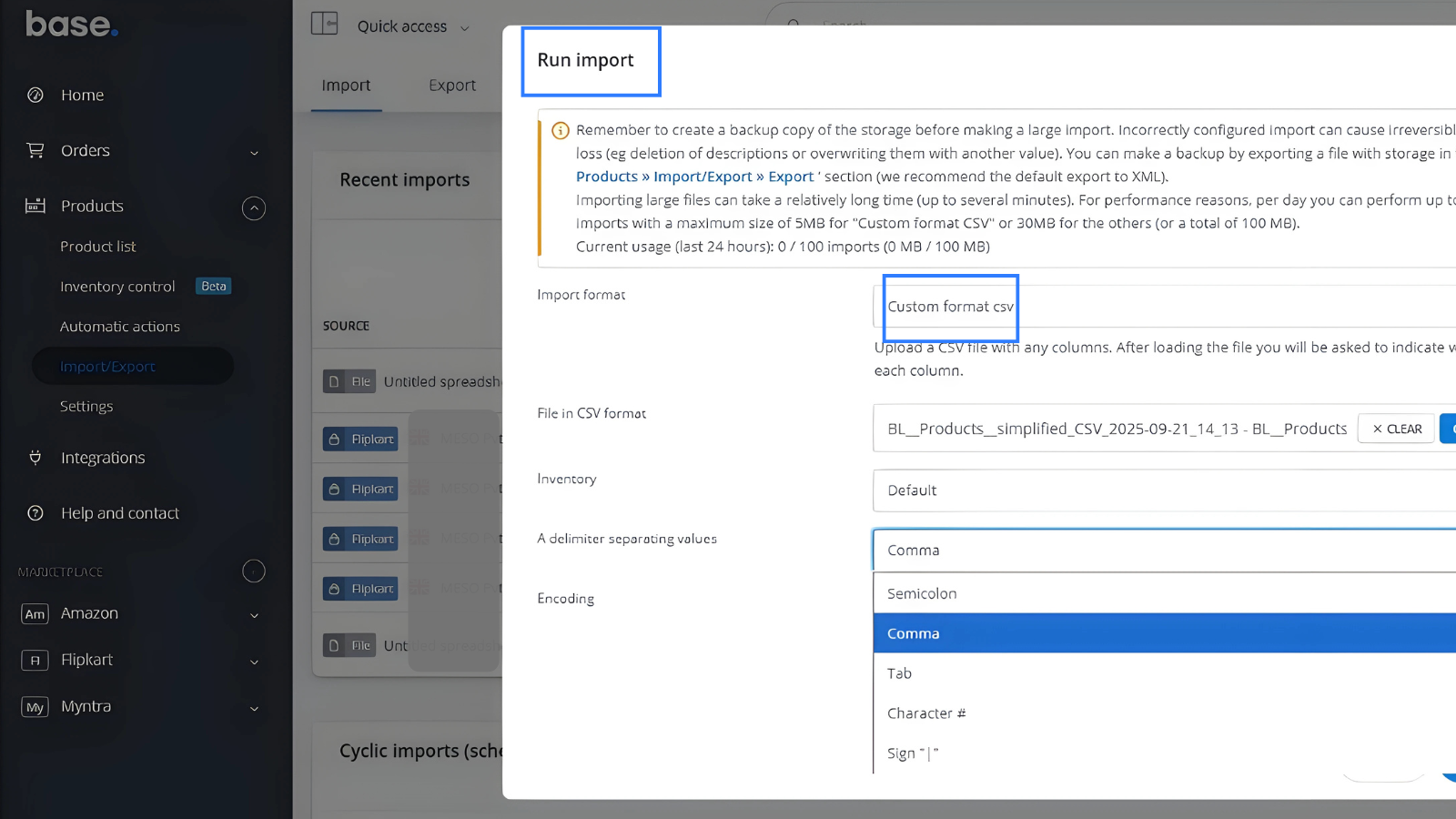

- Centralized product data entry – Sellers can ensure GST compliance through centralized product data entry by maintaining a single CSV/Excel sheet with details such as SKU, product name, HSN code, GST rate, and price. This sheet acts as the source of truth for tax compliance. Updates can also be made efficiently using the Product Wizard, where items can be filtered by tax slabs or categories and edited in bulk in one go.

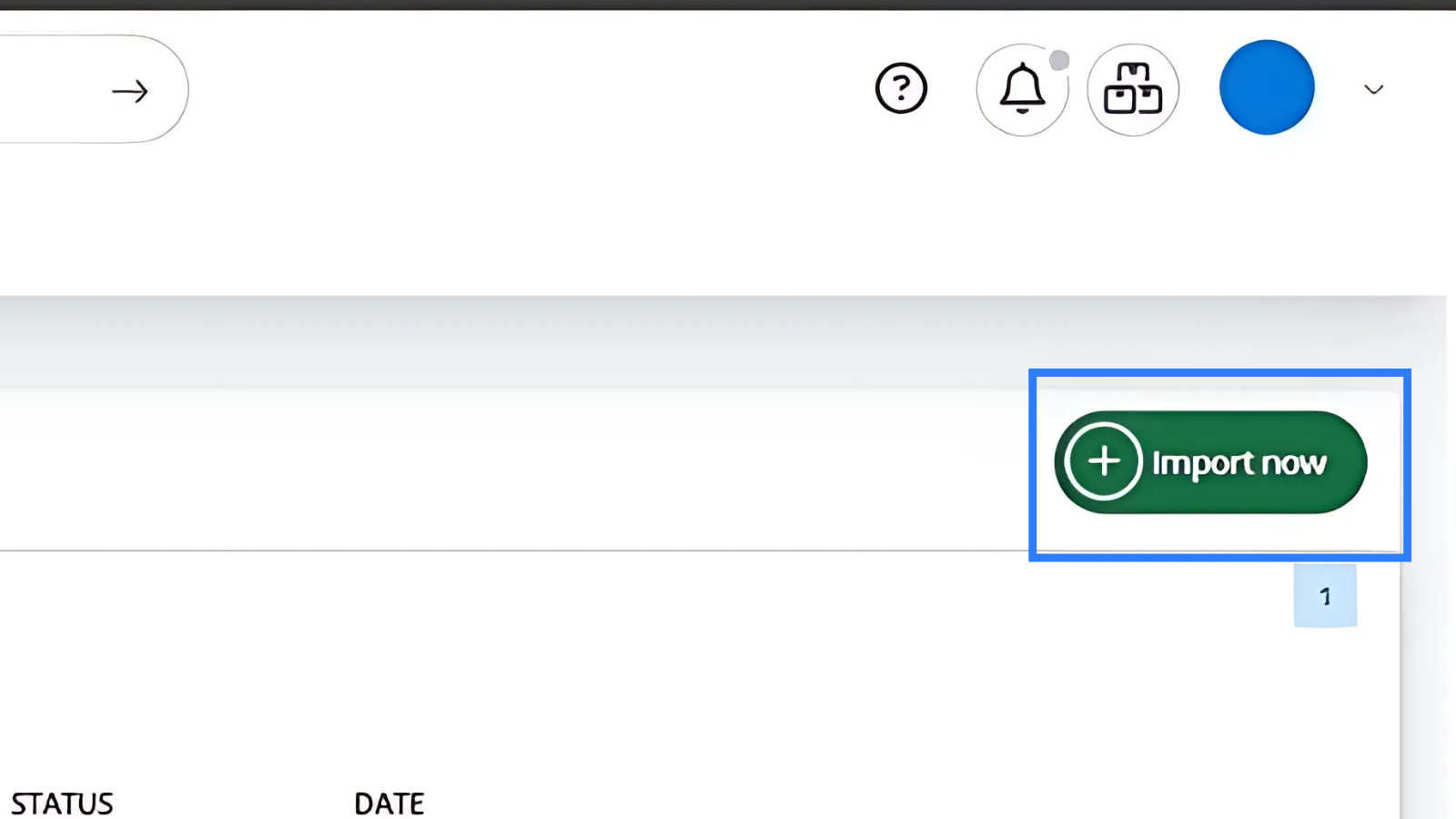

- Time-saving and accurate – For larger catalogs, sellers can use the bulk upload process. This requires preparing a CSV file in the format: SKU/Base Product ID and the updated GST rate. Once uploaded, the system applies the changes across all listed products, making GST updates accurate, fast, and scalable.

- Consistency across sales channels – Once uploaded, the system applies correct GST rates to every channel where the product is listed, whether on Amazon, Flipkart, Meesho, Myntra, or the seller’s own online store. This ensures that there are no discrepancies in how tax is charged across platforms.

- Validation and error-checking – The system runs automated validation on uploaded data. It checks if HSN codes are valid, GST rates match prescribed slabs, and mandatory fields are complete. Any errors are flagged before finalizing the upload.

- Practical example – A seller uploads the following Excel sheet:

| SKU | Product Name | HSN Code | GST Rate | Price |

|---|---|---|---|---|

| 101 | Cotton Shirt | 6105 | 5% | ₹999 |

| 102 | LED TV | 8528 | 18% | ₹29,999 |

The system automatically maps these SKUs to their respective tax rates, ensuring that invoices, ITC tracking, and GST reports remain consistent.

- Adaptability during policy changes – With frequent GST updates, bulk upload allows sellers to quickly revise thousands of SKUs in one step. For example, when paneer moved to a nil GST slab in September 2025, sellers could update their catalogs immediately to remain compliant.

Overall, bulk upload ensures GST compliance is efficient, scalable, and audit-ready while minimizing manual workload.

Step-by-Step Workflow for Sellers

| Step | Action | Details |

|---|---|---|

| Step 1: Setup GST in Base | Enter GSTIN in profile, upload HSN codes, and map tax slabs. | Ensures the system has all compliance data ready before transactions begin. |

| Step 2: Bulk Upload Products | Use Excel template with SKU, HSN, GST rate, and thresholds. | Upload into Base; the system validates the file automatically to prevent misclassification. |

| Step 3: Order Processing & Discounts | Import orders from marketplaces and apply discounts. | Base recalculates the net taxable value; correct GST slab is applied automatically. |

| Step 4: Invoice Generation | Generate GST-compliant invoices instantly. | Invoices include GSTIN, HSN, GST slab, and split taxes; system integrates with warehouse printing. |

| Step 5: GST Reports & Filing | Download reports for GSTR-1, GSTR-3B, and reconciliation. | Match TCS/TDS deductions and file returns via the GST portal or connected APIs. |

| Step 6: ITC Tracking | Upload purchase invoices and reconcile with liabilities. | Ensures accurate Input Tax Credit claims and smooth compliance during audits. |

What are the Best Practices for Sellers Using Base.com?

E-commerce sellers operate in a fast-changing GST environment where even small errors can result in penalties, blocked ITC, or delayed settlements from marketplaces. By embedding compliance into daily operations, sellers can avoid disruptions and maintain trust with both customers and tax authorities. The following best practices provide a simple framework to stay compliant while using Base.com.

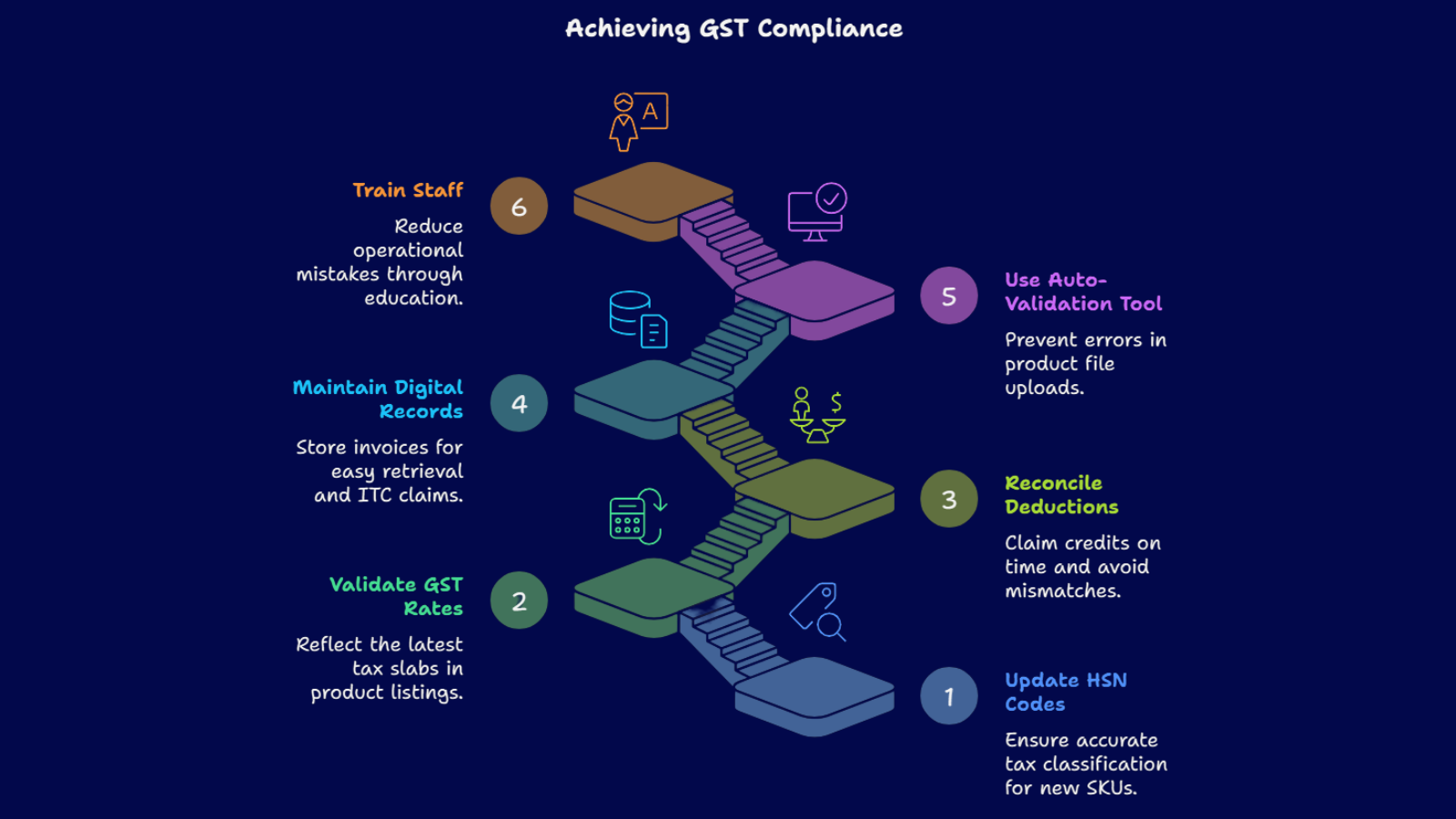

- Update HSN codes for every new SKU to ensure accurate tax classification during invoicing and GST return filing.

- Validate GST rates after each GST Council meeting, such as the September 2025 revisions, so product listings always reflect the latest slabs.

- Reconcile TCS and TDS deductions monthly to claim credits on time and avoid mismatches in GSTR-1 or GSTR-3B filings.

- Maintain digital records of purchase invoices in Base’s Vault module for easier Input Tax Credit claims and quick retrieval during audits.

- Use Base’s auto-validation tool before uploading bulk product files to prevent errors in HSN mapping, GST slabs, or threshold-based pricing.

- Train staff periodically on GST compliance workflows to reduce operational mistakes during catalog updates or order processing.

Conclusion

For e-commerce sellers in India, GST compliance is both a challenge and an opportunity. Mistakes in invoicing, product classification, or reconciliation can result in penalties, blocked ITC, and even suspension from marketplaces. At the same time, accurate compliance reduces costs, improves working capital, and strengthens consumer trust.

Base.com addresses these challenges through automation. As a modern inventory and order management platform, it automates bulk uploads of SKU-level GST details, ensuring correct HSN codes and tax slabs are consistently applied across all channels. Its multi-slab engine automatically adjusts GST when discounts or promotions change product thresholds, removing manual intervention.

Invoicing is generated instantly in GST-compliant formats, while reconciliation reports for GSTR-1, GSTR-3B, and TCS/TDS are auto-prepared, reducing human error and saving time. With proactive updates aligned to GST Council changes, Base.com transforms compliance from a manual burden into an automated workflow, letting sellers focus on growth and customer satisfaction.

Frequently Asked Questions on GST Compliance 2025

Q1. What are the new tax changes for 2025 in India?

The 56th GST Council Meeting (Sept 2025) reduced GST on essentials like paneer, dairy, footwear, and soaps to 5%, while luxury and sin goods including cigarettes, pan masala, and caffeinated beverages were raised to 40%. Provisional refunds for inverted duty structures were also introduced.

Q2. What is the GST rate in India in 2025?

GST in India continues with four primary slabs: 5%, 12%, 18%, and 40%. Essentials generally fall under 5%, standard goods at 12% or 18%, and luxury or sin products at 40%. Certain categories, like healthcare kits and green energy products, also benefit from reduced 5% rates.

Q3. What is the GST 7 2025?

GST-7 refers to Form GSTR-7, a return filed by persons required to deduct Tax Deducted at Source (TDS) under GST. It contains details of TDS deducted, liability, and payment. In 2025, the filing process and due dates remain unchanged, with digital reconciliation requirements made stricter.

Q4. What is the GST notification for 1 2025?

GST Notification No. 01/2025, issued in January 2025, formally notified revised GST rates effective from 22nd September 2025. It included slab reductions for essentials, rate hikes on luxury goods, and guidelines on faster provisional refunds for inverted duty cases. Sellers were instructed to update compliance systems immediately.

Click here to compare the 2024 and 2025 GST regimes and understand how the changes have impacted sellers in terms of pricing, compliance, and business operations.